How Digital Arrest Works: Methods and Ways to Avoid It

Sourav Banik

Author

In North Delhi, a government official was duped out of ₹14 lakhs in a single day after he fell victim to the digital arrest scam. The cyber arrest scam is a type of cybercrime where cyber criminals impersonate law enforcement officials and falsely convince people to pay a hefty sum of money. In 2024, 11 lakh cases of cyber arrest were reported, and even in 2025, the scam continues to rise.

But why do such scams occur, and what is the solution to avoid such fraud? This blog will focus mainly on what and how cyber arrest works, and help you detect the early warning signs to avoid such scams.

What is Digital Arrest?

Digital arrest is a sophisticated fraudulent activity where the fraudsters generally impersonate a cyber officer and manipulate individuals into believing that they are under a cyber arrest. This usually happens over a video call or phone call, where the cybercriminals force the victim to transfer money to their bank accounts or they will be arrested soon.

The criminals often impersonate officials from law enforcement agencies such as the Commissioner-in-charge or Officer-in-charge from the Telecom Regulatory Authority of India (TRAI). They usually do a video call or a voice call on WhatsApp, where they manipulate the victim into believing that a criminal case has been registered against them.

Let us get deeper to understand the modus operandi of the scam.

Read about commercial crime insurance and its coverage details.

Is Digital Arrest Legal?

No, such arrests are never legal. If you search through the pages of law enforcement, you will never find any term known as online arrest. This is because cyber arrest is neither legal nor does law enforcement have any provision for such terms. The digital arrest meaning has been coined by fraudsters to simulate the fear of intimidation inside the minds of victims and force them to transfer money to the fraudsters. Usually, people who are emotionally vulnerable, and have a scarcity mindset are the easiest target for this type of fraud. People are susceptible to such frauds because they are threatened with strong legal actions, which immediately creates fear among people.

What is a Digital Arrest Example?

Let us take a fictional example to understand how this cyber crime works. Mr. Bhushan, a 65-year-old retired officer, receives a sudden video call in his WhatsApp account. The caller claimed that a case of serious money laundering had been traced to the SIM Card of Mr. Bhushan.

The unknown caller then switched to a video call on WhatsApp and introduced himself as an RBI officer. He announced that Mr. Bhushan’s SIM Card and Aadhaar Card had been used for laundering money across national borders, and he was framed for such serious crimes under house arrest.

The caller gives an ultimatum that unless Mr. Bhushan transfers ₹20 lakhs, he will be arrested with imprisonment of a minimum of 15 years. Transferring the funds seemed the only way out for Mr. Bhushan, and he immediately transferred the amount to a UPI ID shared by the caller. Soon after that, the caller disappeared without a trace. Mr. Bhushan tried to connect to the number, but it turned out to be switched off. Neither did the messages of Mr. Bhusan get replied to afterward.

This case highlights the process of digital arrest meaning. A cyber arrest works exactly this way, where the cybercriminal appears as an authority figure, and creates fear among the victim’s mind to force them to transfer hefty amounts.

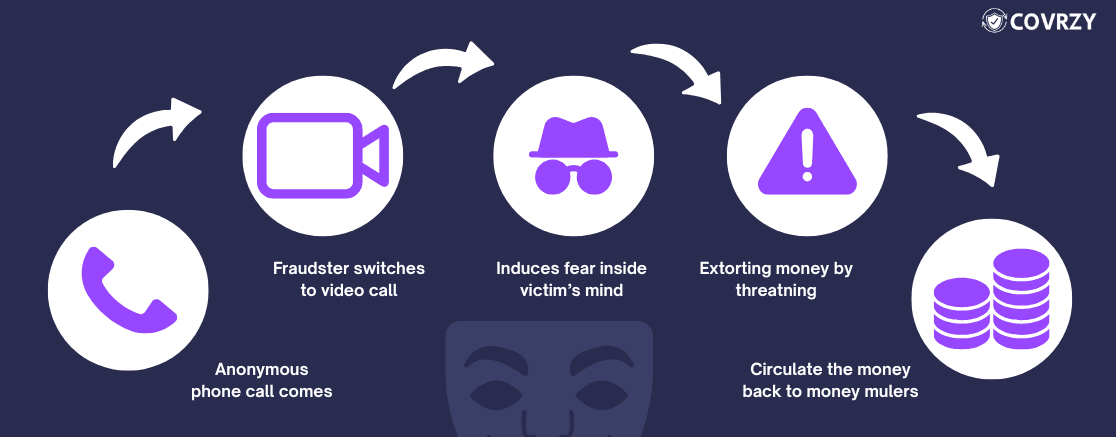

Below is a step-by-step breakdown of how the scam works.

How does the Cyber Scam Work?

Digital arrest is not a random unplanned fraud. In reality, it consists of a strategically planned method that cybercriminals use to trap innocent victims. Here are all the stages of how the fraud activity takes place.

Stage 1. Setting up Contact

The fraud starts with a phone call, where the spoofed number looks quite close to a legitimate government contact. The caller informs the victim that a fraudulent financial transaction such as money laundering has been found in the victim’s identity.

Stage 2. Switching to Video Call

Once the victim is sufficiently terrified, the caller takes advantage of the situation and commands the victim to connect in a video call for verification. The victim then receives a WhatsApp video call, where the scammer may be dressed in a police uniform that may look legitimate.

Stage 3. Psychological Control

The third step is intensifying the terror in the mind of the victim. To do this, the caller ensures that the victim does not contact anyone else from outside, and does not inform anyone of the call. Victims are then interrogated for hours and are threatened that a digital fraud arrest has been issued in the name of a victim under the National Security Act.

Stage 4: Extortion

When the scammer has built up sufficient psychological pressure and authority, they start demanding immediate payments. To not arouse suspicion, the scammers often term payments as security fees, and sometimes even as verification charges. The payment is done via UPI or crypto payment, after which the scammers hastily disappear.

Stage 5: Money Circulation

The collected money from the scams immediately goes to the money mules. These money mules are individuals who lend their bank accounts to receive the victim's money, and then transfer it to third-party bank accounts to avoid suspicion. Usually, the scammed money is used to buy cryptocurrencies, or even deposited into small finance banks that do not require much verification for creating accounts.

Also read how to check your CIBIL score in simple steps.

Real-Life Case Studies of Digital Arrest

Case Study 1: ₹7 crores defrauded from a businessman

In August 2024, the scammers defrauded an 82-year-old businessman of ₹7 crore. The victim was informed of his potential involvement in a case of money laundering and was forced to stay on cyber arrest for straight 2 days.

Case Study 2: ₹60 lakh from a retired factory officer

A retired officer in Jabalpur was defrauded of ₹60 lakh, where the scammer informed the victim that a case of National Security Act had been registered against her and her SIM Card would be deactivated. Fearing the consequences, the victim immediately transferred ₹60 lakhs to the fraudster’s UPI ID.

Case Study 3: Professor Defrauded of ₹2.81 Crore

A professor from SGPGIMS Lucknow was contacted by individuals who claimed to be CBI officials. They alleged that her account had been used in a money laundering case, and she may face long jail terms if not complied with. The professor transferred ₹2.81 crores before realizing she had been a fraud.

Case Study 4: Retired Scientist Scammed of Life Savings

A shocking case came up when a retired scientist lost her entire life savings to a cyber arrest scam. The fraudsters had defrauded the scientist by isolating and threatening her for days. The incident happened quite recently and was posted to LinkedIn by her daughter.

Case Study 5: Tech Employee Loses ₹11.8 Crore

A 39-year-old software engineer had fallen prey to the digital arrest scam where he was kept on a video call for nearly 48 hours by the scammers. The fraudsters posed as TRAI individuals and convinced him that his bank account had been used for money laundering. To avoid arrest, the victim resorted to paying ₹11.8 crores.

Read also how to do GST registration in easy steps.

How to Avoid a Digital Arrest?

Insuring against such cyber crimes should be the first step. Here are some of the steps that you can take to avoid cyber arrest scams:

Law Enforcement Does Not Ask for UPI Transfer

Police or any law enforcement individuals do not ask to transfer money through UPI IDs or international wire transfers. All such orders and claims are actually fraudulent.

Interrogation On Video Calls is Sign of Fraud

Police, CBI institutions, or TRAI never interrogate individuals via WhatsApp or Skype. The foresight sign of fraud is the caller asking for a video call to verify the identity of the victim.

Do Not Share Personal Information

The main strategy of scammers is to use their fear against you and take advantage of you to transfer the money. Never share your PAN Card details or Aadhaar Number even if anyone claims to be from TRAI or CBI. Also, avoid sharing OTPs and bank details with people over video calls or voice calls.

Never Share OTPs or Passwords

Never share your OTPs or bank account details such as login PIN or login details with the concerned bank. In case you get calls from unknown numbers claiming to be bank officers, immediately report and block such numbers for your safety.

Educate Your Team

As a business owner, you should take the first step to educate your team to avoid all such scams. Creating alerts and training your HR departments for mandatory cybersecurity awareness can be a starting point. The employees should be aware of how to detect fraud by warning signs.

Insuring Against Cyber Crime

Most businesses such as IT companies are one step away from losing their substantial revenue because of such frauds, cyber insurance offers holistic coverage to financially cover such scams. Cyber risk insurance offers strong protection against multiple offenses such as cyber extortion, malware attacks, or phishing attacks.

Red Flags To Look Out For

Always watch out for these warning signs whenever you receive any intimidating message or call from any unknown number.

- Unknown calls via WhatsApp or request to download Skype

- Request or command to switch to video call for verification

- Asking to transfer money via UPI or net banking to avoid arrest

- Long interrogations that continue for 48 or 72 hours These are the main warning signs that the caller is a fraud and it is a potential cyber arrest case.

How Can You Complain About a Digital Arrest Scam?

Whenever you encounter any of these warning signs, immediately take these steps in the next 24 hours.

Step 1: Register a formal FIR complaint

You can directly visit your nearest police station, or log in with your details to your state customer portal. Lodge an FIR as soon as you can, as a formal FIR alerts the authorities and they get on to track the trail of money better.

Step 2: Report to the Cyber Crime Portal

The immediate step is to call the toll-free number 1930, or visit the official cyber crime portal and register a complaint. To do this, you need to visit the official portal, click on “Register a Complaint” and then select the “Financial Fraud" option.

Step 3: Fill Personal Details in Cyber Portal

Enter correct details of yourself such as your full name, residential address, registered phone number, and so on. These details ensure that your complaint is registered successfully and will help you to file a lawsuit. Complaining and taking action is the only way to recover your lost money, so never stay silent as soon as you detect any fraudulent behavior. Staying silent gives power to cyber criminals, hence complaining is necessary to create awareness and also stop more cyber arrest scams.

Conclusion

Now you know that a digital arrest is not any legally recognized step that police or law enforcement authorities would take. In India, the term online arrest has no relevance and is only used by fraudsters who try to extort money from individuals based on fear and intimidation. These scams have been rapidly increasing, mostly among senior citizens and non-tech-savvy adults because of their low digital literacy and lack of cyber awareness. While scammers can always change their way of defrauding people, the common trend in these cybercrimes is asking to do a video call and transfer bulk money to unknown accounts. Staying alert and immediately reporting to the cybercrime portal is a way to prevent these scams in the future.

Businesses are always vulnerable to cyber extortions and fraud because of the large volume of customer-sensitive data they deal with. Cyber insurance can provide them with strong coverage against multiple cyber attacks such as malware attacks or cyber extortion. Let Covrzy’s in-house experts help you find the best quote for 360-degree coverage for your firm. Our insurance advisors are IRDAI licensed and have already helped more than 500 businesses across India.

Frequently Asked Questions

Explore moreWhat is the punishment for digital arrest?

There are several legal provisions that hold digital arrest scams as a severely punishable offense and subject individuals to imprisonment for 2 or more years. IPC Section 506, Section 504 and Section 468 are applicable in this case and can sentence an individual to long-term imprisonment for committing cyber fraud.

Is digital arrest legal in India?

The online arrest is illegal and a cyber fraud. Indian law enforcement does not have any term or provision for cyber arrest, hence it is not legal.

How to complain about cyber arrest?

Whenever you face online arrest, always lodge an FIR with your nearest police station. The next step is to lodge a formal complaint with the cybercrime portal of India by submitting our details and describing the online fraud.

Can evidence collected during digital scam arrest be used in court?

All videos or audio collected during such incidents are regarded as admissible proof in a court of law. You can submit such cases as proof directly to your attorney.

Can I use my phone recording as evidence?

Yes, you can use your phone recording as a roof in court to testify against the fraudsters.

How many days do cybercrime inquiries take?

Cybercrime inquiries may take a long period of time depending on the amount of money fraud, and the complexity of the entire situation. It can be anywhere between a few weeks to several months.

Is FIR compulsory if I face cyber arrest?

Yes, in case of cyber arrest, lodging a formal FIR complaint is mandatory. By lodging a formal FIR, your case is submitted to the police and a formal search begins for the perpetrator.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.