How To Check CIBIL Score Free? Step-by-step Process

Sourav Banik

Author

Introduction

CIBIL score measures the degree of credit you can be allowed to borrow from financial institutions. Having a higher credit score means you can easily borrow from banks and various financial houses, at a higher credit limit. Imagine being overhauled with a financial emergency, and you are in urgent need of funding. By having a higher CIBIL score, you can easily borrow funds overnight, with an easy loan application process. This means that you will be able to borrow the required credit in no time, as financial corporations are more likely to advance credit to individuals having high credit scores. Knowing your CIBIL score is vital, as you can make informed decisions and also leverage your financial portfolio. Let’s now understand how to check CIBIL score free online with the right steps.

Factors That Affect your CIBIL Score

The credit score however depends on these five major factors:

- The past credit history

- Frequency of credit transactions

- Borrowings taken in the past

- Date of debt repayment

- Multiple borrowings with lapsed repayment

Although CIBIL doesn't exactly mention the actual parameters affecting the score, yet these factors play a crucial role in impacting your credit score. In this blog, you will get to know in detail the steps to check CIBIL score by PAN Card without OTP. Before we jump right into the details, let us know how credit score works.

How Does CIBIL Score Work?

A good credit score will provide benefits to you such as:

Low Rate of Interest

A high CIBIL score means you can take loans at a much lower interest rate. Most banks and financial creditors offer loans at low interest rates for businesses with high credit score as it means they are able to repay loans easily

Faster Approval Process

A fast process for loan approval is ensured for businesses with a high CIBL rating. Banks generally consider businesses with a good credit score as a safe customer which will repay quickly, hence the loan approval process does not take much time

Higher Loan Amount

High loan amounts are generally offered by banks to businesses with a high credit score. High credit rating often shows the capability of a business to repay the loan, hence banks do not hesitate to offer a high amount.

Late Repayment and Long Tenure

A longer tenure of loan repayment is also offered to individuals and businesses with a high CIBIL rating. Usually banks consider such businesses safe to be trusted with a high amount of loans, hence they are allowed a longer tenure.

What Is a Good CIBIL Score in India?

Many of us still don’t know what is a good CIBIL score for having a credit card in India. While a poor CIBIL score may prevent your business from applying for higher loans, a high CIBIL rating will equally offer you a better opportunity to borrow. When you look for an online CIBIL score check, you may observe that the CIBIL score ranges from 300 - 900. This is the ideal score range, where the lowest is 300 and the highest is 900, both implying positive and negative credit history. CIBIL has prepared a table for businesses and borrowers to describe the ideal credit scores that they should have. Check the table below:

| Credit Score | Implication |

|---|---|

| NA/NH | An NA(Not Applicable) or NH(No History) score usually indicates the business has never before borrowed before or may have not registered for any borrowings |

| 300 - 680 | This score usually means the business has a history of failed loan repayment or a delayed loan history, or multiple failed EMI payments in the past |

| 681 - 730 | This score indicates that the business may struggle in repaying its loan timely. This score is not too negative, yet it shows that a business may have difficulty in repayment of credit |

| 731 - 770 | This range is an improved score, and businesses with this score have better opportunities to apply for credits |

| 771 - 790 | This is a highly positive score. Usually businesses that do timely repayment and also have not applied for multiple credits, receive this score |

| 791 - 900 | Businesses that have no default history and have always secured timely payment belong to this range. These businesses have consistent history of repayment, and usually clear out payments before deadline expiry |

A score above 770 is considered highly positive. If you are running a business and want to have a robust financial outlook, then try to check CIBIL score free by visiting the official website of CIBIL and clicking the “Get Free CIBIL Score” option.

Once you are aware of the exact credit score, it will help your business to secure funds easily and make better financial decisions. Businesses with higher CIBIL scores are likely to get easier funding as compared to businesses with low credit scores. Scroll below to find how to do a CIBIL score check free online by PAN number.

Your company Director is still exposed to a high risk of losing his personal assets if there is no Directors and Officers Liability insurance enabled. Get your Director insured with D&O Liability Insurance at low premium with Covrzy, and shield them financially.

How To Check CIBIL Score Free?

Checking your CIBIL measure does not need to be complex. Let’s browse through these easy steps that will help you to check CIBIL score free.

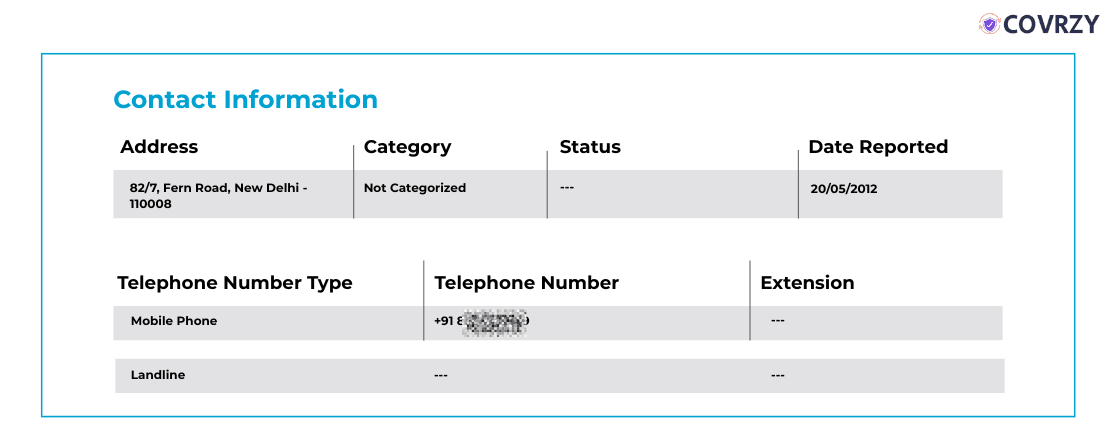

Step 1: Visit the official website of CIBIL and click on “Get Started Now”. If you are a first-time user, you will have to create your account with CIBIL by filling out all the necessary information such as full name, residential address, and contact information.

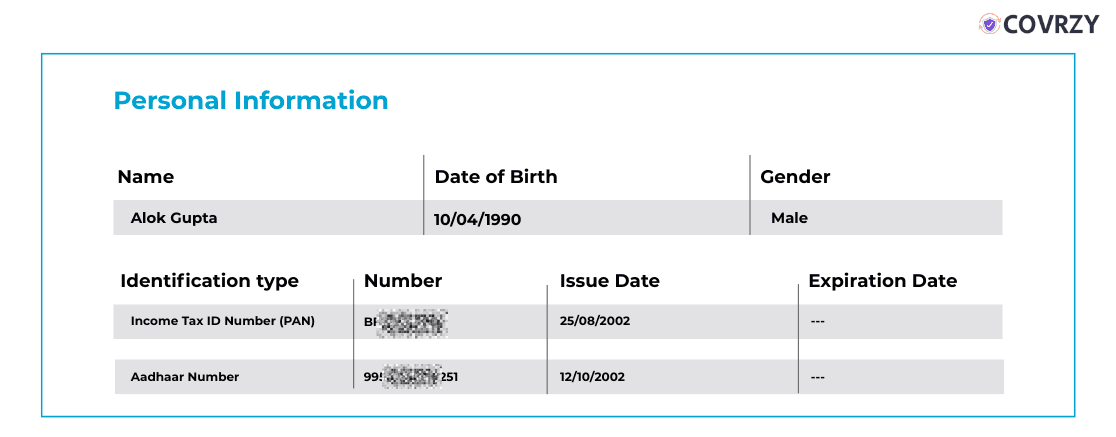

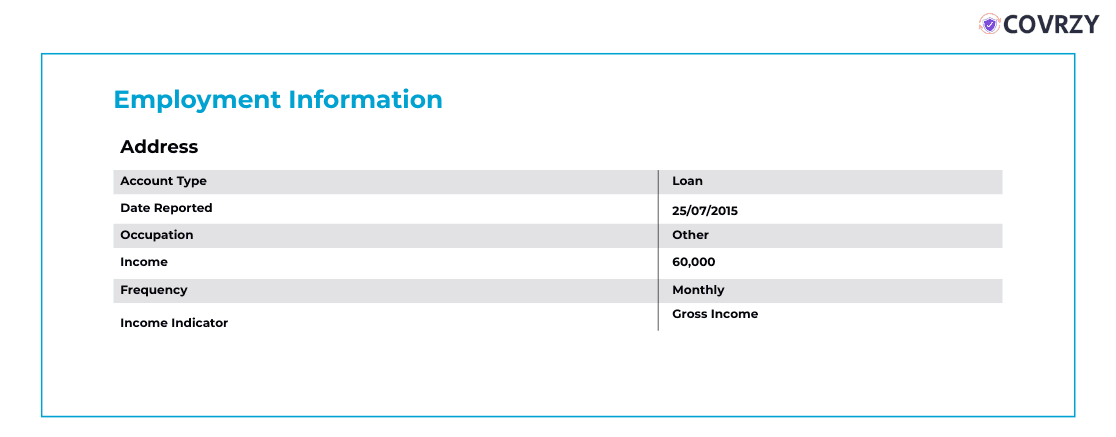

Step 2: Next you have to register information such as: Aadhaar Card Number PAN details Employment ID Annual income

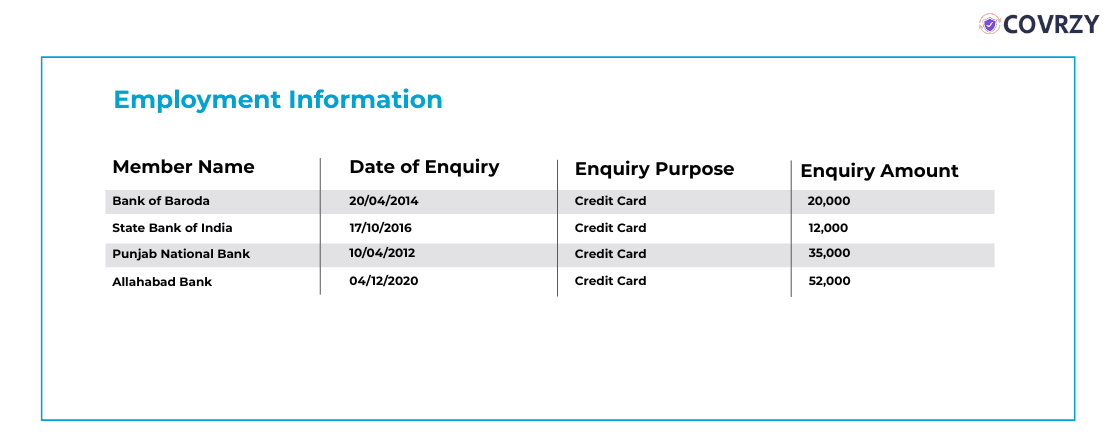

Step 3: Fill in the information that requires your previous loan information. This can be your loan repayment date, borrowing date, and bank name.

Step 4: Click on “Submit” and the process will come to an end. Depending on the accuracy of the information that you have submitted, you will receive your CIBIL score report within 6 months.

How To Check CIBIL Score By PAN Card?

If you are looking to check CIBIL score by PAN Card without OTP, then there are some steps for you to start with. While ordinarily, you would need to verify your account with the OTP, you can check your CIBIL score without it also. For this, you have to use a third-party CIBIL score institute. There are multiple institutes that offer a quick CIBIL score update, you only have to register with them and fill in your personal information.

Step 1: Use Third-party CIBIL Score Checker

There are multiple third-party websites that you can visit when you search how to check CIBIL score. However, two things to keep in mind.

- Always visit a site that is officially registered with CIBIL such as a reputed banking service

- Never use any services without OTP, as that possesses a security vulnerability.

The reason is that OTP serves as a security check when you are filling out private information such as PAN card details and Aadhar information that needs some security verification. Without an OTP it can be risky enough, as OTP verification adds a layer of security to identity verification. Enter your personal details and PAN Card details. You may also have to enter your mobile number and address to receive the score.

Step 2: Submit Your Details

Click on the “Submit” or “Get Credit Score” option.

Difference Between CIBIL Score and Credit Report

Many commercial institutions often use these two terms interchangeably, although there are some differences between them.

| Factors | CIBIL Score | Credit Score |

|---|---|---|

| Issuing Board | This score is issued by the Credit Information Bureau (India) Limited (CIBIL) | This score can be estimated by an authorized financial institution |

| Credit Worthiness | This score measures the credit worthiness of a business or individual in repaying loans | This score measures the ability of repaying any borrowings in a given deadline, it also reflects repaying ability for multiple credits |

| Factors To Construct Report | This report is prepared after CIBIL understands the previous credit history of a business or individual | This report is determined based on major factors such as credit history, credit mix, how much credits have been utilized and any number of default cases |

| Measurement Board | CIBIL score is measured by CIBIL | Credit score is measured by various autonomous institutions such as TransUnion, Experian |

| Monitoring Authority | CIBIL score is measured as according to the guidelines issued by the Reserve Bank of India | Credit score is measured according to these autonomous institutional guidelines, these may depend on financial regulations of the concerned nation |

Advantages of Having a Good CIBIL Score

It is always recommended for a business to have a higher CIBIL score because of multiple reasons.

Improved Loan Access

Businesses that have a higher CIBIL rating can easily file for loans than a company with a low rating. A higher score is convincing proof for the lending institution that your business has a better ability to repay within the given time. You may proceed to the official site of CIBIL or any authorized institutions that provide CIBIL score check and measure your credit score.

Low Interest Credits

Borrowing at a higher interest rate is every founder’s nightmare. Often repaying at a high interest rate takes on a heavy financial toll, creating a debt trap for the business. This may be a strong reason as to why you should also do CIBIL score check free from time to time, and maintain it above 700.

Also know the top government subsidy loans to apply for.

Higher Limits To Borrow

The major reason as to why your company should be maintaining the CIBIL score above 700 is you get the benefit of borrowing at higher limits. While your business will be expanding, you will be requiring larger investment. A high CIBIL score serves as a golden ticket for financial authorities to approve loans with higher limits for your business.

Easy Access To Commercial Credit Cards

If you are a business owner or a salaried employee, having access to a business credit card is an opportunity that no one wants to miss. Businesses with high CIBIL scores can apply for commercial credit cards with ease, expecting early dispatch. You can cater to all your investment needs with a commercial credit card easily, which is why maintaining a high credit score is significant.

How To Improve Your CIBIL Score

Improving your CIBIL score is necessary to maintain a consistent financial portfolio and get your future loans easily approved. Note down these strategies to improve your CIBIL rating:

Maintain Deadline Reminder

Keeping up a deadline reminder is the first step to develop a timely habit of repayment. You can manually set up calendar reminders for immediate payment deadlines, or opt for a fintech app that keeps on sending reminders to you for timely repayment.

Always Perform Route CIBIL Score Check

Checking your credit score routinely is a way to avoid a negative score. CIBIL score aims to let your creditworthiness remain positive so that you can have easy access to loans. Try a free CIBIL score check by logging into the CIBIL website and checking the actual result.

Avoid Multiple Borrowings

Another important step that you can take is to restrict your business from applying for multiple borrowings. Too many borrowings can easily lower the credit score, as for every borrowing you need to have a strong collateral. Moreover, having multiple borrowings can showcase to your stakeholders that your business is financially unstable.

Apply For Longer Credit Tenure

Whenever you are applying for credit, ensure that you are applying for a longer repayment duration. For example, if your businesses need to take credit of ₹2,00,000, it is ideal to apply for 2-4 years to repay that debt rather than a 6 months tenure.

Know the top venture capital firms to get credit for your business.

Periodically Check CIBIL Score

Keep on checking your credit rating periodically, as it you can track any fluctuations in your credit that way. This not only maintains a healthy credit ratio, but it also keeps in check once your credit score falls below 700. If you are looking to check CIBIL score by PAN Card without OTP, always remind yourself to check once in a month.

Always Settle Complete Debt

Do not fall for the debt trap by partial repayment of the loan. At the date of repayment, always pay in full for the loan. If you settle for partial payment, the remaining unsettled amount may add up to all of your existing debt.

Why To Check Credit Score?

Before you know how to check CIBIL score free, know the main reason why checking your credit score matters.

Take Strategic Decisions

Your business can make strategic decisions knowing their ability to borrow. Credit score signals a company on the ease of borrowing, and also alerts them if they need to improve their creditworthiness.

Plan Better Investment

Your business might have a planned investment portfolio after the CIBIL score check. You can easily plan out your investment decisions, such as choosing between short-term and long-term borrowings.

Also read top zero investment business to start in 2025.

Helpful In Stakeholder Management

Your business will have updates on market debts, which will drive it to manage its funds better. In addition, you can be more transparent to your business stakeholders about the financial updates.

Become Aware of Liquidity Position

Doing an online CIBIL score check makes you aware of the liquidity position of your business. This will be immensely helpful to disburse payments and negotiate with your business vendors. Also, you may be onboarding new clients depending on the financial performance of your business.

How to Rectify an Incorrect CIBIL Score?

Know your CIBIL Rating

The first thing to do is to know your exact CIBIL rating. After you have applied for an online CIBIL check, wait till your report is generated. As soon as it is generated, look at it and try to understand if your score is too low or moderate.

Identify Major Errors

Identify the errors such as unpaid loans or multiple loans taken in your credit score report. Understand each of these errors accurately, and make a note of these errors.

File a Complaint

Login to your CIBIL account with Transunion CIBIL or Umang, and find the complaint section. Click on it and fill out the form for submitting your complaint

Wait For Resolution

Usually a resolution to rectify your incorrect score takes 30 days to 45 days. It can even take a few months depending on the queue, after which you will receive an email notification for rectification. If this does not solve your problem, you may have to email the Income Tax Department or solicit professional advice from a registered Chartered Accountant.

Conclusion

CIBIL score shows the degree of your loan repayment ability, so it is a measure you can use for your benefit. If anyone has taken an unauthorized credit in your name or has misutilized your personal information for taking up loans can be easily found out by a CIBIL score check free online by PAN number. CIBIL score lets you understand your credit health, making it easier for you to manage your loans and make financial decisions better. Whether your loan will be approved or rejected depends on the credit score, so it serves as a vital parameter for your commercial success too.

Frequently Asked Questions

Explore moreHow to generate CIBIL score for the first time?

If you have no past credit history or do not know your CIBIL score, the first step is to start using a credit card. You can apply for a credit card with your bank, provided you earn a fixed income every month and you have a positive credit history.

How to check my CIBIL score without OTP?

If you want an online CIBIL score check without OTP, the best thing to do is to register with a third-party CIBIL score checking app. There are various third-party sites that offer dedicated CIBIL scores without verifying with OTP. It is however recommended to always verify OTP for adding security.

What is a good credit score?

A good credit score should always lie above 700, as a score higher than 700 implies that the borrower may repay the credit within repayment tenure. If you want to keep a score above 700, always do a free CIBIL score check periodically.

How can I increase my CIBIL rating?

To increase your CIBIL rating, first visit the official portal of CIBIL. You can select the “Get Started Now” option and fill in all your personal information. After submitting, you can expect to receive your CIBIL report within a month. The report will make you aware of your score, which you can keep as a parameter to improve. You can then plan on actions such as borrowing loans with higher tenure, repaying loans within deadline and not borrowing multiple credits. These actions can eventually promote your CIBIL score.

How can I get a 900 CIBIL score?

To get a 900 CIBIL score, you need to keep a deadline reminder for all of your borrowings. In addition to that, perform a monthly CIBIL score check free by visiting CIBIL or any third-party site to keep yourself updated about your score. Avoid over-borrowing and always settle your market credit in time to ensure your score remains at 900.

What is the highest credit score?

The highest CIBIL rating is 900, which is determined as being the highest rating. Businesses with a 900 CIBIL rating can easily get loan approvals and also enjoy low interest rate loans from banks.

Can I get a zero credit score?

You cannot possibly obtain a zero credit score, but do not have any past credit history, your CIBIL score will show as Not Applicable.

Can I live without any credit or loan?

You can live without any loan or credit by not purchasing any commodities or assets in EMI, and also by adopting a minimal lifestyle. Also, you should not use credit cards frequently and even if you do, try to repay the debts in time. This is a great way of harnessing a debt free lifestyle too.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.