How to Manage Corporate Health Insurance Premium After a Layoff?

Sourav Banik

Author

Many of us don’t know how to manage our corporate health insurance premiums after being laid off. This is a common problem that employees often encounter, especially when they don’t have any guidance or clarity.

In India, employer-funded health insurance continues to play a crucial role due to low insurance penetration. Given the rising cost of healthcare, most Indians would prefer a group employee wellness plan to cover their medical and family expenses financially.

However, the question remains: what happens to the premium when an employee is terminated or resigns? We will discuss this along with other crucial questions in this blog.

Do You Get a Refund on Premium of Corporate Health Insurance?

After an employee is laid off , the premium is typically treated according to the policy's terms and conditions. If the policy terms don't allow mid-cancellation, the premium will be treated differently. Let’s understand this with an example.

Case Study Example

Vinayak has been working with a SaaS company in Pune for 2 years now, where the company has provided him with a corporate group health insurance worth ₹5 lakhs. The premium of the policy costs ₹2,000 monthly. However, the board members decided to reduce the workforce and terminated a few positions, including Vinayak.

What will happen to the insurance premium of Vinayak after being laid off?

Case 1: The Policy Gets Cancelled

The policy will automatically stop once the employee has left the organization. The employee cannot claim any refund on the premium because he is no longer part of the organization, and unless the insurer allows a mid-term cancellation, refund is not allowed.

Case 2: If The Insurer Allows Mid-Term Policy Cancellation

The insurer will partially refund the premium, known as a pro-rata refund on unused coverage amount. This however, depends entirely on the terms and conditions of the insurer. If the insurer does not allow any refund, an employee may not claim any refund.

Read about the benefits and how to apply for critical illness insurance.

What Happens to Your Premium After Layoff?

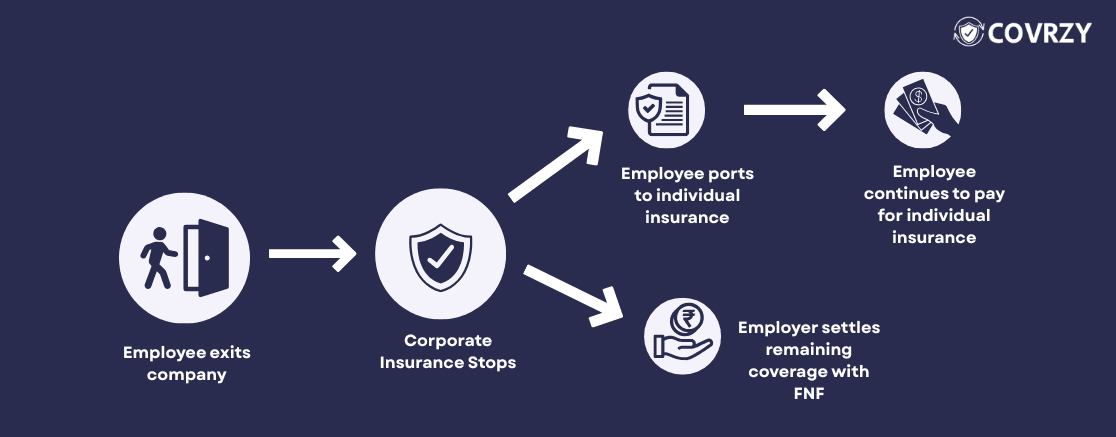

After his resignation, premiums of corporate health insurance plans can be treated in two different ways.

Case 1: Voluntary Resignation

If an employee resigns of their own will, the premium will not be refunded. The employee can also port the policy directly to an individual health insurance and get the benefits.

Case 2: Organizational Layoff

If the organization terminates an employee, the employer bears the responsibility to update the insurer about the discontinuation of the policy. The employer will then adjust the remaining coverage with the FNF amount, only if this benefit was deducted from the employee’s salary during inception.

Do You Need to Pay Premium After Termination?

After termination, the employee does not have to pay for any premium. The policy for the employee becomes inactive, and the employee does not get any claim benefit.

Continuing The Corporate Health Insurance Policy

If the employee decides to continue with the policy, he can simply port it to an individual health insurance or migrate the policy to a new insurer. In such a case, he has to continue paying off the premium although he is no longer employed. There can be multiple reasons for this, such as the employee does not want to lose the insurance benefits or wants to let the policy stay active for health reasons.

Policy Discontinuation

A corporate policy is automatically discontinued once the employee exits the organization. In such a case, the employer will be updating the insurer about discontinuation of the policy.

Although if the employer still chooses to continue the policy even after the employee resigns, the remaining coverage will be settled by the employer only. The employer may settle this by adjusting the amount with the FNF settlement of the employee.

Read also how to do EPF Registration online in 2025.

How is Insurance Premium Settlement Treated in FNF?

This can be better explained with the same example we took earlier, Vinayak’s case.

This is how Vinayak’s salary slip looks:

Employee Name: Vinayak C. Rajdhar

Employee ID: VNYK0257

Designation: Associate Software Developer

Work Location: Bengaluru, Karnataka

Date of Payment: 10.05.25

*all amount indicated in ₹ per month

| Earnings | Amount | Deductions | Amount |

|---|---|---|---|

| Base Salary | 50,000 | EPF | 14,400 |

| HRA | 10,000 | Professional Tax | 200 |

| Performance Bonus | 25,000 | LOP | 8,000 |

| Internet Reimbursement | 3,000 | Employee Health Insurance | 2,000 |

| Gross Salary | 88,000 | Total Deductions | 24,600 |

Net Salary: ₹63,400

On occasion of Vinayak being terminated, the insurance premium of ₹2,000 will stop and Vinayak will lose claim benefits. If the employer still decides to continue the insurance policy after his termination, the employer can settle the remaining coverage with the FNF amount.

Read also the top employee wellness programs for a healthy workplace.

How to Manage Corporate Health Insurance Premium After Layoff?

As long as the employee was employed, the employer would pay for the premium of corporate group health insurance for employees. After a lay-off, the scenario changes. The employer then gets to decide the fate of the policy as per the terms of the organization. Post termination is financially challenging for every employee.

Here are some of the tips to strengthen yourself financially after you are laid-off:

Understand your Financial Condition

Your financial condition is the best judge to let you decide if you want to continue with the policy or terminate it. Assuming that you may have to wait another few months before your next employment, consider all of your income and expenses. You can freelance during this time, which is financially helpful to pay for the premium.

Port to Individual Insurance

The post-termination situation is financially constraining. You can consider migrating to individual insurance from corporate health insurance plans. This can help you to pay the premium in instalments. Many insurers consider installment-based payments, too, which you need to inquire about.

Focus on Necessary Expenses

After a layoff, the financial portfolio generally stays weak, so considerprioritizing your expenses Revise and eliminate unnecessary expenses, such as streaming subscriptions. Because health insurance is necessary to sustain a modern lifestyle, you may continue to pay for the premium in installments till your next job.

Conclusion

Getting terminated from your job brings on a financial disaster, unless you have a second income line for constant earnings. While you become financially vulnerable, you can also take steps that would strengthen your financial position such as cost-cutting and lowering your spending.

Migrating your corporate health insurance to an individual insurance during this time is wise rather than completely discontinuing it, as you may have to pay higher premiums if you start a new policy. Check out the best quotes with Covrzy employee wellness plan, an affordable insurance solution for all team sizes.

Frequently Asked Questions

Explore moreIs my corporate health insurance still active after a layoff?

After being laid off, your corporate insurance benefits automatically stop if you do not convert it into an individual health insurance. By requesting your insurer, you can port the plan into an individual insurance plan.

How do I cancel my insurance after being laid off?

You do not have to cancel your insurance as it automatically gets cancelled. If your employer still continues the policy till its next renewal date, they can do so by deducting the remaining premium from your full and final settlement.

What can be a backup plan after being laid off?

After being laid off, a strong and essential backup plan will be to start freelancing in your domain, and start aggressive saving. You can cut off all idle and unnecessary costs, and keep a dedicated ledger to track your expenses.

How to convert company health insurance to individual health insurance?

You corporate health insurance policy into an individual one by requesting your insurer with appropriate policy documents and health reports. Your insurer may have to underwrite the policy and revise the premium based on a reassessment of your health risks.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.