How To Do EPF Registration Online? [Updated 2025]

Sourav Banik

Author

![How To Do EPF Registration Online? [Updated 2025]](/_next/image?url=https%3A%2F%2Fstrapi.covrzy.com%2Fuploads%2FEPF_Registration_featured_image_f9ee75890c.png&w=3840&q=100)

Employees Provident Fund (or more shortly, EPF) is a government-framed scheme, operated under the Employees Provident Funds and Miscellaneous Provisions Act, 1952. While most employees would think to save a smaller percentage of their income for retirement, EPF is a scheme that helps with that. The concept of EPF is thus more of a savings scheme that helps employees easily retire without worrying about their old age. This blog is going to explain the process of EPF registration for all the employers in India, whether that is a startup or a small-scale business.

What is EPF?

EPF full form is the Employees Provident Fund, operated under the surveillance of the Employee Provident Fund Organization. Provident Fund refers to an arrangement of funds to be used in the future for an individual. While most states bear a strict rule in providing EPF, it lies with the discretion of the employee to not choose to contribute towards a provident fund, in case they are earning more than ₹15,000 monthly.

Let’s get to this with a better example.

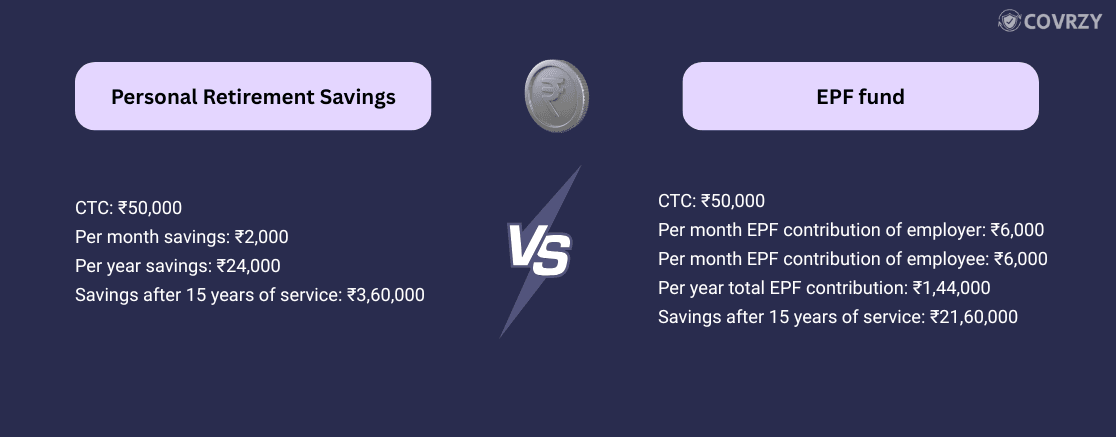

Ishika works as a white-collar employee in the sales department of a Gurugram-based company, and her current CTC is ₹50,000 including DA and other allowances.

Out of her monthly salary, she manages to save ₹2,000 per month. This savings is meant to serve as her retirement fund after she has retired from regular service. Ishika has been saving this for the last 5 years, and she plans to retire after another 10 years.

What will be the total retirement fund of Ishika when she has retired after 15 years of service?

Total retirement savings = (2000 * 12 * Number of years of employment) = (2000 * 12 * 15) = ₹3,60,000

Would this amount be higher if she had opted out of EPF instead of saving each month? Let’s see.

Because the organization that Ishika is a part of, employs more than 20 members, both Ishika and her company will be equally contributing an EPF of 12% monthly. This means they both will be contributing (50000 * 12%) or ₹6,000 each per month.

The total EPF fund after a total of 15 years will be

= [EPF contribution per month) * 12 * Number of years of employment]

= [(6,000 + 6,000) * 12 * 15] = ₹21,60,000

We can find that the EPF amount is much higher than the total retirement fund after 15 years.

This is the reason why most employers provide an EPF, as it is a way of contributing a significantly high amount to employees when they are retiring.

Are you covered against major corporate risks, such as a corporate governance failure, or a claim from your shareholders? Such risks not only tarnish your reputation but also disrupt your business to a great extent. Covrzy brings Directors and Officers Liability insurance plans to cover risks of financial expenses during lawsuits, as well as cover your assets in such cases.

Why Does an Employer Need To Register for EPF?

There are several reasons as to why EPF is a compulsory strategy for all employers.

Compliance With Employment Laws

The first reason for EPF creation online is to comply with the basic legal requirement of running a business. The Indian government has mandated employers to file for EPF in case the organization has employed more than 20 employees, as per the Employees’ Provident Funds And Miscellaneous Provisions Act, 1952.

Ensuring Flexible Employment

Employers provide EPF on the ground that their employees will enjoy higher retirement savings upon retirement from the company. EPF also provides a much better work environment by creating a fund for retirement, as private corporate employees do not usually get the benefit of a monthly retirement withdrawal, which EPF helps with.

Read about how to pay TDS online for your business.

Creating Employee-Friendly Culture

EPF tends to create an eployee-friendly culture by developing a long-term asset. It removes the worry of most employees who are planning to save and provides them with a lump sum while they are about to retire.

Meet Emergency Requirements

When an employer chooses EPF signup, they are meeting the emergency requirements of their employees. Employees can meet their financial needs easily out of the EPF fund, to which the employer and employee - both contribute equally.

Employers become prudent by contributing towards EPF equally, while employees feel cared for and offer better work commitment. EPF thus produces a win-win situation for both the employer as well as the employee. Now, if you are looking for the latest news on EPF interest rate 2024-25 and how to register for it, let’s proceed forward.

How To Do EPF Registration Online?

Let’s now move to know the process of EPF registration for small businesses and startups in simple steps. The process of registration has changed for employers or businesses who are registering for the first time, here is a detailed step-by-step guide.

Steps For EPF Registration For Employers

The process of EPF registration online has been classified into two distinct parts for your ease of understanding.

PART I

- Visit the Unified Shram Suvidha portal

- Register your business with your full name, email ID, mobile number, and a CAPTCHA code.

- After signing up, you will receive a verification mail confirming your successful signup in your registered email. The email will contain a registration link, click that

- You will be taken to a new page, where you have to solve the CAPTCHA to generate an OTP

- As soon as you click “Submit”, you will receive an OTP in your registered mobile number. Input that OTP in the new page for OTP verification

- You will be prompted to set up a new password with your new username

- Fill in the required fields and your registration will be completed. You will receive a popup dialog box stating that your registration has been completed with the Shram Suvidha portal

Understand the difference between a partnership and LLP

PART II

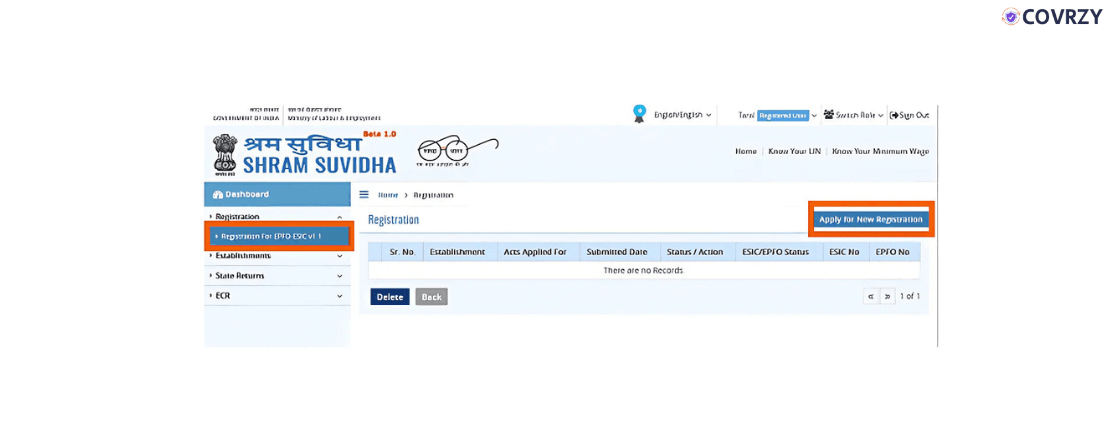

You will be required to log in again with your username and password Click the “Registration under EPF-ESI” option under the Registration option A new window will open named "Registration for EPFO ESIC”. Click “Apply for New Registration".

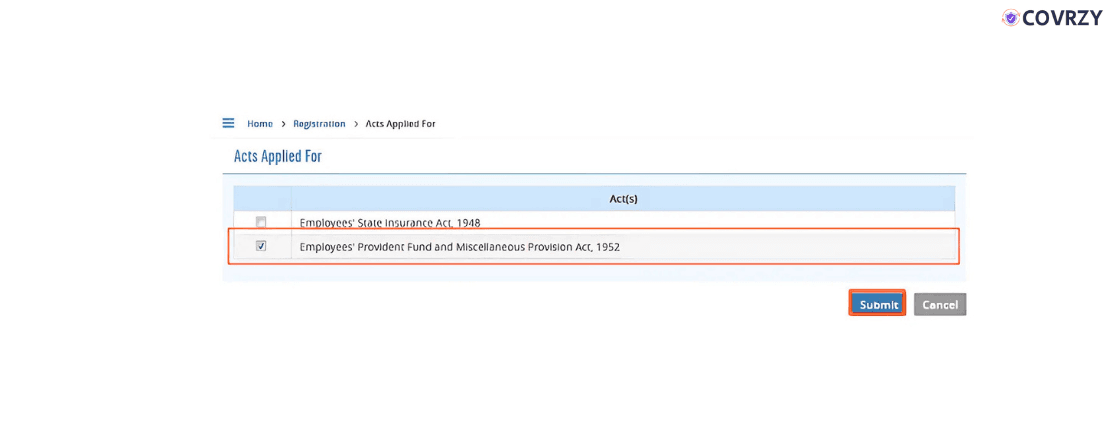

Select the Act as “Employees’ Provident Fund and Miscellaneous Provision Act, 1952”

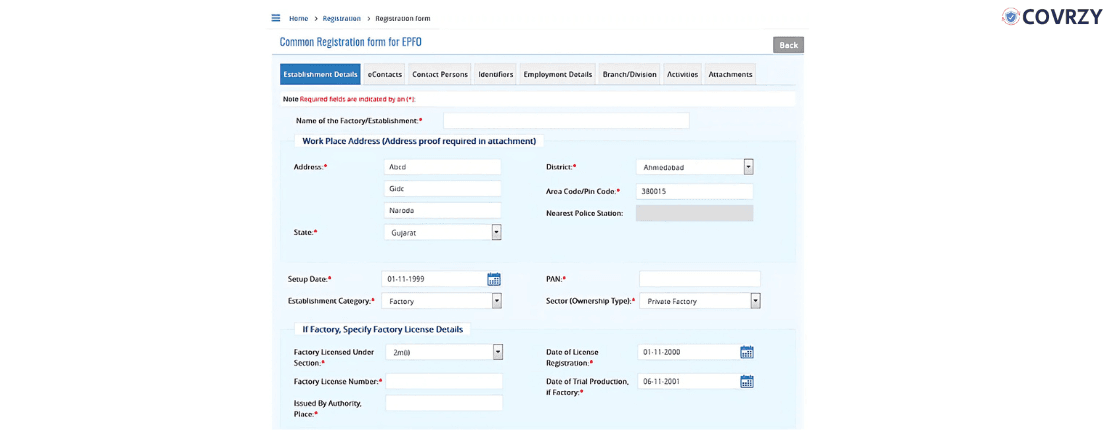

A new option for filling out all the required employer details will pop up You have to carefully fill out all the other details such as Establishment Details, eContacts, Contact Person, Employment Details and few more

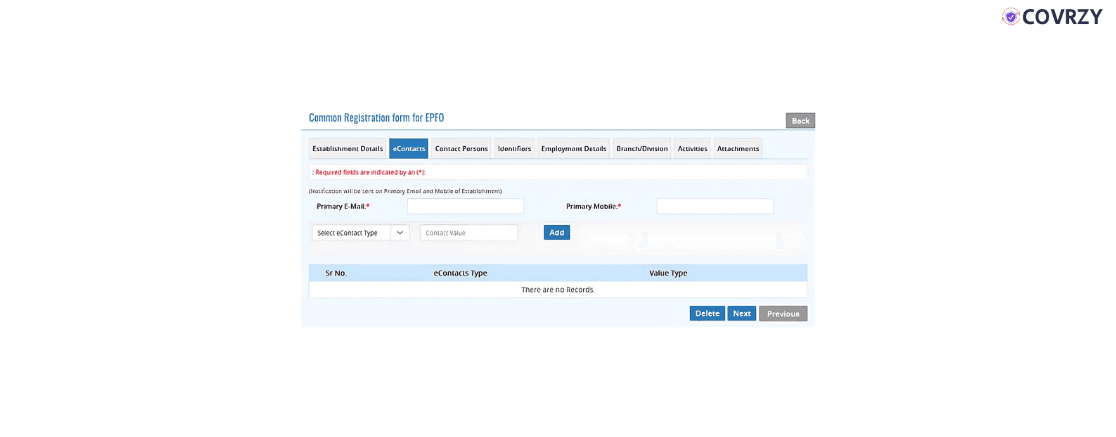

Fill out your email details in the eContact details

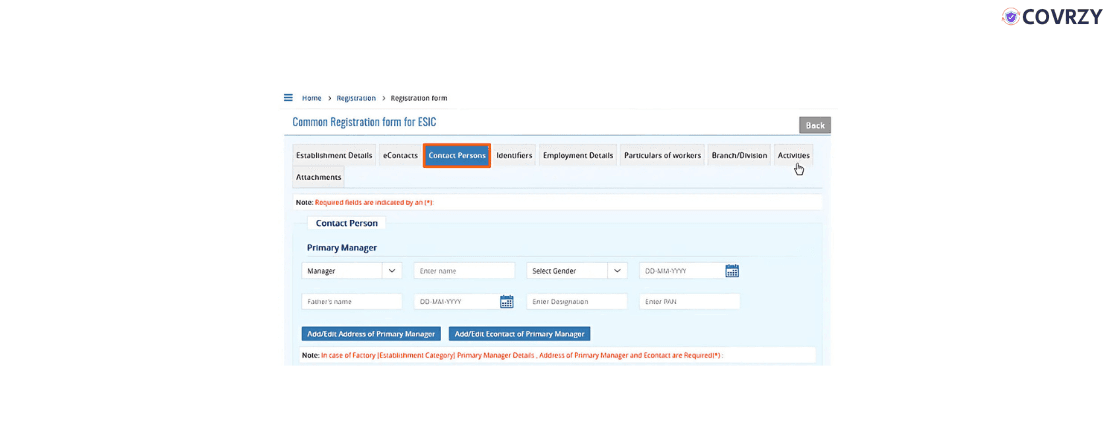

Next, click Contact Persons to fill out the manager’s details such as Date of Birth, Father’s name, gender, PAN Number

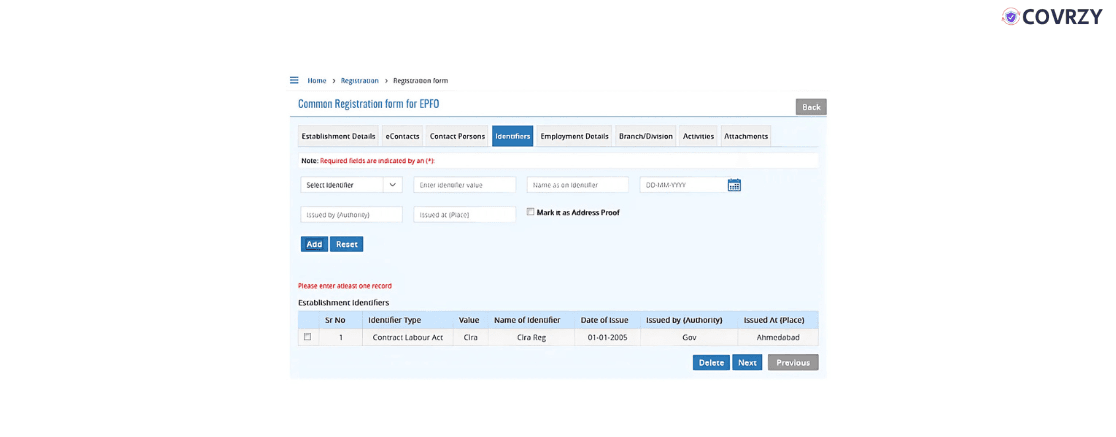

Click next on Identifier to fill up the identifier option. Your Aadhar Number or your PAN Card number can be an identifier number.

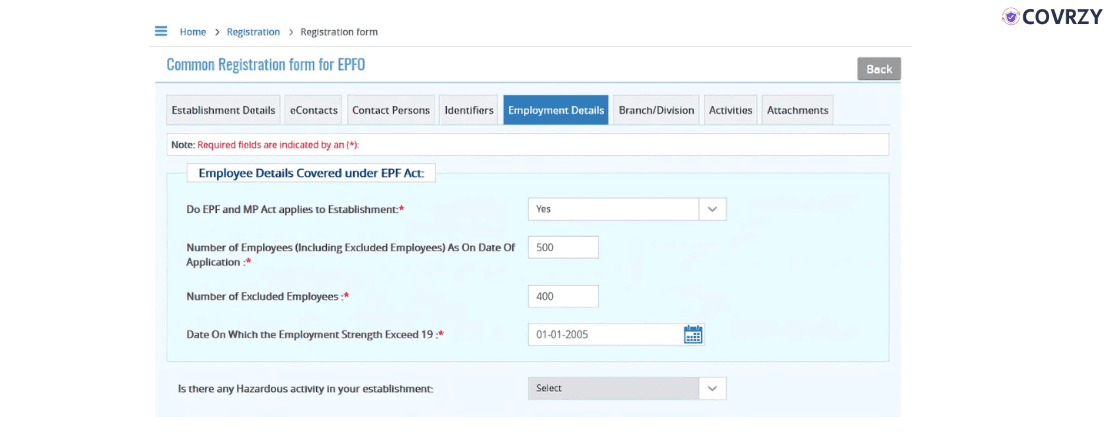

Next, visit the “Employment Details” page and fill up the details such as number of employees working, number of contractual employees, leasing information in case you have taken the workplace in lease

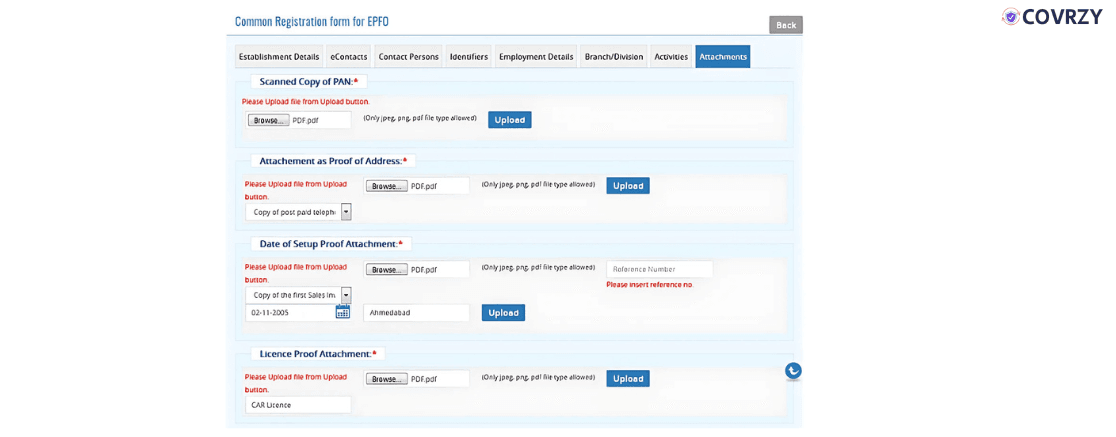

The next step will be to fill up the Branch details and fill the “Activities” section. Your last step will be to fill up the Attachment section, where you have to submit all the necessary details such as PAN Card details, Address proof, Cheque proof, and scan of Business License documents.

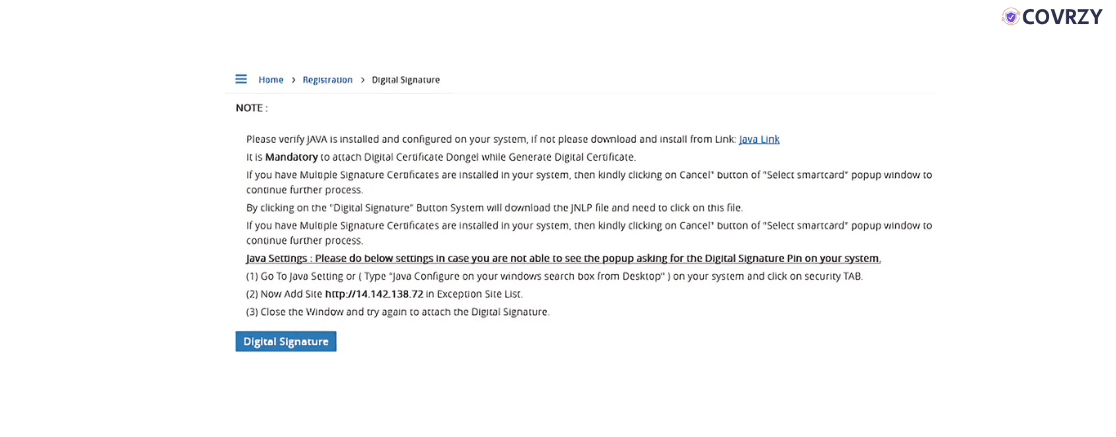

The next page will show the "Digital Signature” option, in which you can simply attach a sample of your online signature. A digital signature is also easy to make, you can simply use an online signature site for it.

Once all of these steps have been completed, you will receive a confirmation mail about your successful signup. Always note that the email is from a verified source, such as the Shram Suvidha Portal Team. Also, take note somewhere that the current EPF contribution rates 2025 are 8.25%. This has been confirmed by the EPFO, where both the employer as well as the employee will equally contribute towards the EPF.

Required Documents For EPF Registration

Take note of all the documents that are needed for EPF creation for new businesses.

- PAN Card details of your business proprietor or business director

- Aadhar Card details of your business proprietor or business director

- Address proof of your business director

- A cancelled cheque

- GST Certificate

- Lease agreement certificate

- Business license certificate

These documents should suffice if you are looking for EPF registration services in 2025. Moreover, all of these documents should have updated information and must reflect the actual information about the business proprietor.

Minimum Number of Employees Needed For EPF Registration

The minimum number of employees required for EPF registration online for companies is 20 members. If your business does not have a minimum of 20 members, for example, a startup that has the least number of employees, your team members can still opt for it. Section 1 (4) of the Act (voluntary coverage case) states that employees can choose to subscribe to EF contributions voluntarily if their employers are not eligible to do so for any reason. Also, organizations that do not have at least 20 members, can still register for EPF where the contribution is different. Both the employee as well as the employer have to contribute 10% instead of 12% as per EPFO norms.

Is EPF Subject to Taxation?

The most direct answer to this question is yes, EPF is taxed. The Finance Act, 2021 has changed EPF tax rules, by imposing TDS on the interest income from EPF. In the budget declaration in 2021, TDS is applicable for any employees earning an interest income from EPF of ₹2.5 lakhs or more annually. Before 2021, EPF income was not subjected to taxation, although now, TDS has been imposed on EPF interest. The reason was to prevent individuals from getting undue advantage of saving tax on their income from EPF interest.

Conclusion

EPF's full form is Employee Provident Fund, a financial scheme made to assist employees during their retirement times. EPF not only provides a financial cushion for its employees but also allows its employees to instill saving habits in them.

However, if you are running a startup, or the director of a small business, navigating through the process of EPF registration can be complex. This blog illustrates all the necessary steps required for a seamless registration by classifying the process into two parts. In case you still cannot register for EPF, check your EPF grievance status by visiting the EPFiGMS portal and selecting the “Register Grievance” option.

Frequently Asked Questions

Explore moreHow to activate my EPF account?

To activate your EPF account as an employer, you should first visit the official site of EPFO and check for EPF registration online. Before that, you should also know the basic EPF compliance for employers to be eligible for successful registration.

I have an inactive EPF account. Can I make it active again?

If you haven’t made any contributions to your EPF account for 3 years, your EPF account will be deactivated. To activate it again, you have to update your KYC details and also verify your details with the EPFO account. You can log in to your account and visit the Help Desk to verify. You can also call the EPF toll free number at 14470 and proceed with instructions.

Is PF compulsory for all employees?

Yes, as per the Employees' Provident Funds and Miscellaneous Provisions Act, 1952, EPF is mandatory to be credited to all employees' accounts if the firm size is 20 members or more.

Which employer is eligible for EPF?

Employers that have at least 20 employees and are registered under the Companies Act, 2013, are eligible to contribute towards the EPF scheme along with the employees.

How to get my employer ID for EPF registration?

You can easily get your employer ID by visiting the Establishment Search option on the official website of EPFO and filling out the online options for the establishment name along with the establishment code.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.