TDS Payment Online: Step-by-step Approach

Sourav Banik

Author

Corporate employees may often hear of the term TDS, a monthly deduction appearing on their pay slips. Yet, many of us don’t know the actual meaning of TDS, how it is calculated, or how to pay TDS online. This blog will walk you through the actual meaning of TDS, and explain step-by-step how to file for TDS.

What Is TDS?

TDS means Tax Deducted at Source. The Income Tax Department of India mandated the deduction of tax on any income for all employees and passed on the tax to the Central Government of India. If you are a business owner, whether it be an SME or a startup, you are liable to deduct TDS from the monthly salary of your employee and credit it to the Income Tax Department. If you are an employee, you will receive an update of a net deduction of TDS from your salary in your salary slip. You can claim tax benefits under TDS deduction by filing your ITR too.

Budget 2025 Updates

The fiscal budget of 2025 brought completely new changes to tax payments. Here is a brief snapshot of all the vital changes that have been brought over by the budget 2025 for TDS deductions.

TDS payment update

- Senior citizen employees will now enjoy a deduction limit of ₹1 lakh instead of the previous limit of ₹50,000

- In case of delayed TCS, no prosecution charges will be paid

- The annual limit on rent has been increased from ₹2.4 lakhs to ₹6 lakhs

- Individuals have to pay high TDS only in case of no PAN Let’s now get to know the exact TDS limits for every income slab.

2025 Budget News

In March 2025, the current finance minister of India declared multiple changes for middle-income earners. For income earners, the 2025 budget has been a boon. All income earners till ₹4 lakhs have been exempted from paying any income tax, so there will be no TDS deducted. Here is a list of TDS payments for all income slabs:

| Income Slab | Effective Tax Deduction |

|---|---|

| Till ₹4 lakhs | Not Applicable |

| ₹4 lakhs - ₹8 lakhs | 5% |

| ₹8 lakhs - ₹12 lakhs | 10% |

| ₹12 lakhs - ₹16 lakhs | 15% |

| ₹16 lakhs - ₹20 lakhs | 20% |

| ₹20 lakhs - ₹24 lakhs | 25% |

| Above ₹24 lakhs | 30% |

Increased Threshold of TDS

In the Union Budget of 2025, the TDS threshold limit had been increased to the previous limit set. For both businesses as well as for individuals, the limit had been expanded to a higher threshold. This is done to facilitate the daily income earners and the middle-class earners of the nation. All of these changes had been made effective by the Income Tax Department from April 1, 2025, in India.

Know the threshold limit for online TDS payment.

| Particulars | Articles | Threshold Limit |

|---|---|---|

| Commission from insurance | 194D | 20,000 |

| Interest on Security | 193 | 10,000 |

| Dividend for individual shareholders | 194 | 5,000 |

| Income from Mutual Fund | 194K | 10,000 |

| Income from windfall earning such as prize, lottery winning, commission | 194G | 20,000 |

| Income from brokerage fee | 194H | 20,000 |

| Fee for professional services/technical services | 194J | 50,000 |

| Rent | 194-I | 2,00,000 |

How To Do TDS Payment Online?

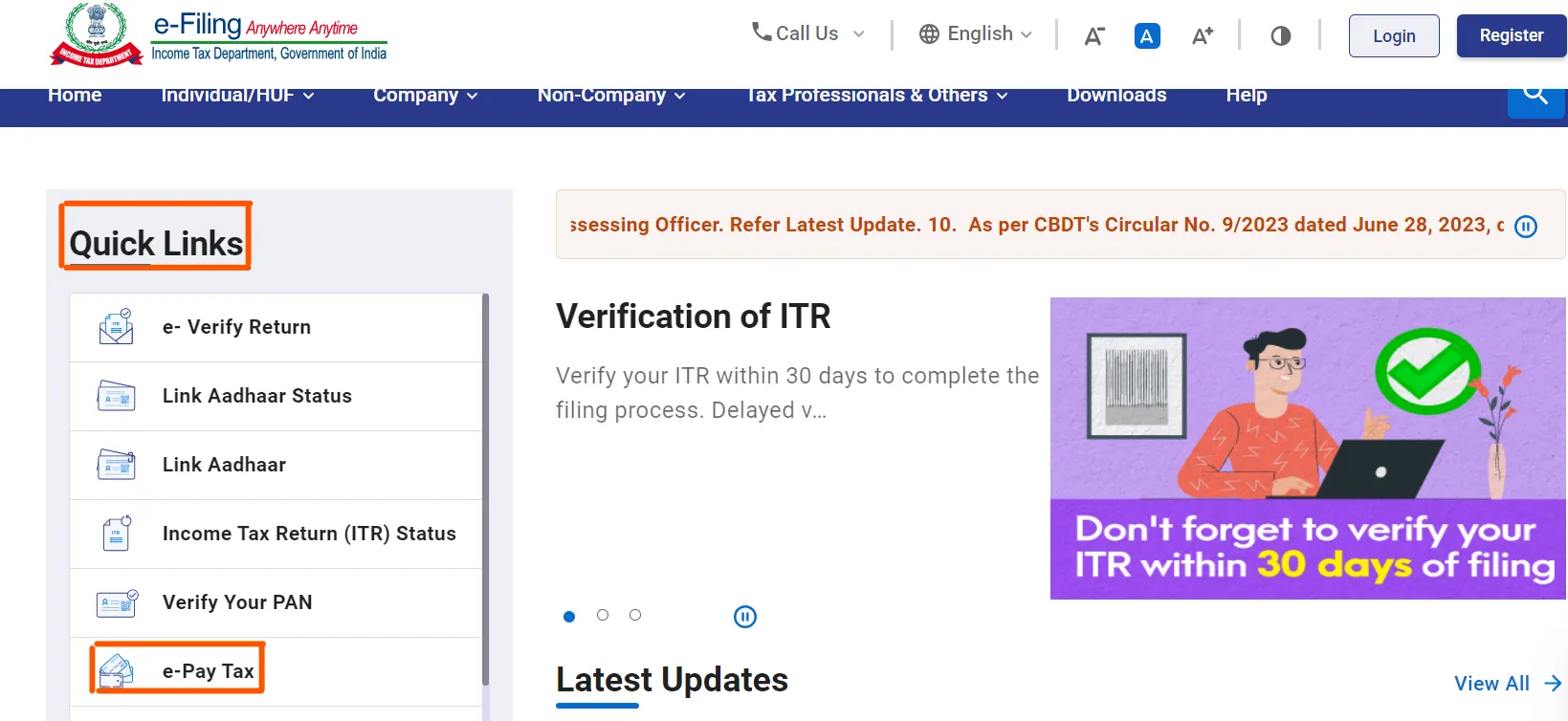

Doing TDS e-payment is easier once you get yourself right with these steps. But before we begin, note that you will have to register yourself as a new tax payer if you are a first time tax payer. You can visit the official portal here for registration.

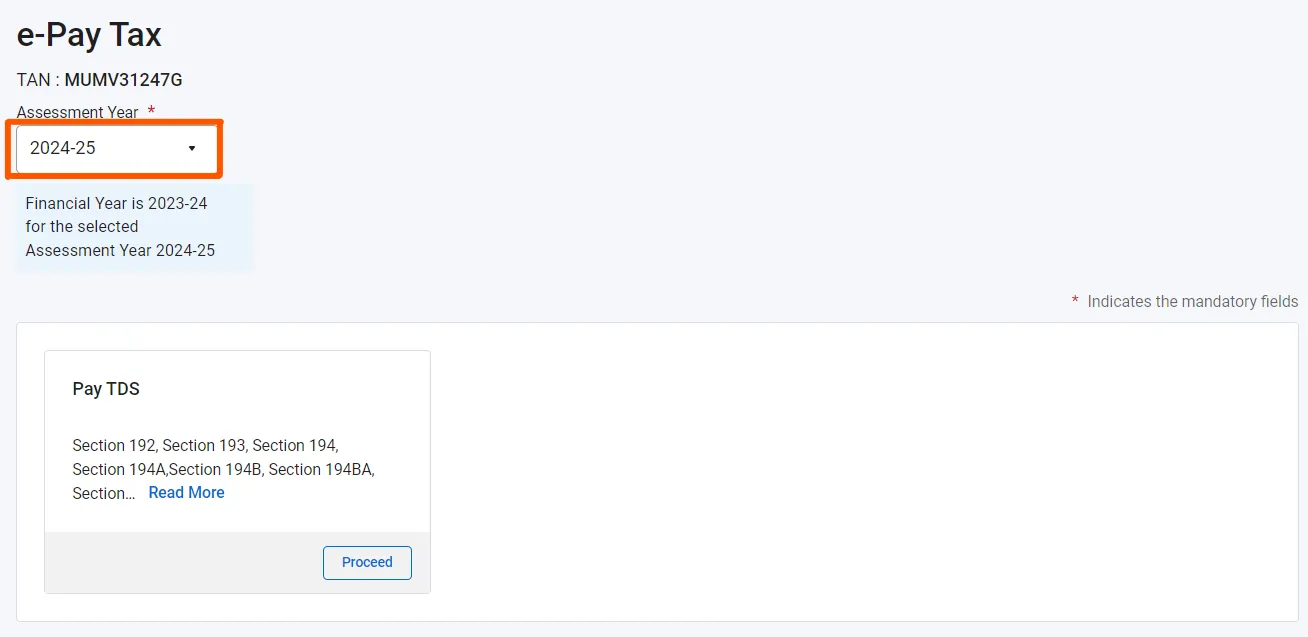

- Step 1: Click on the “e-pay Tax” option

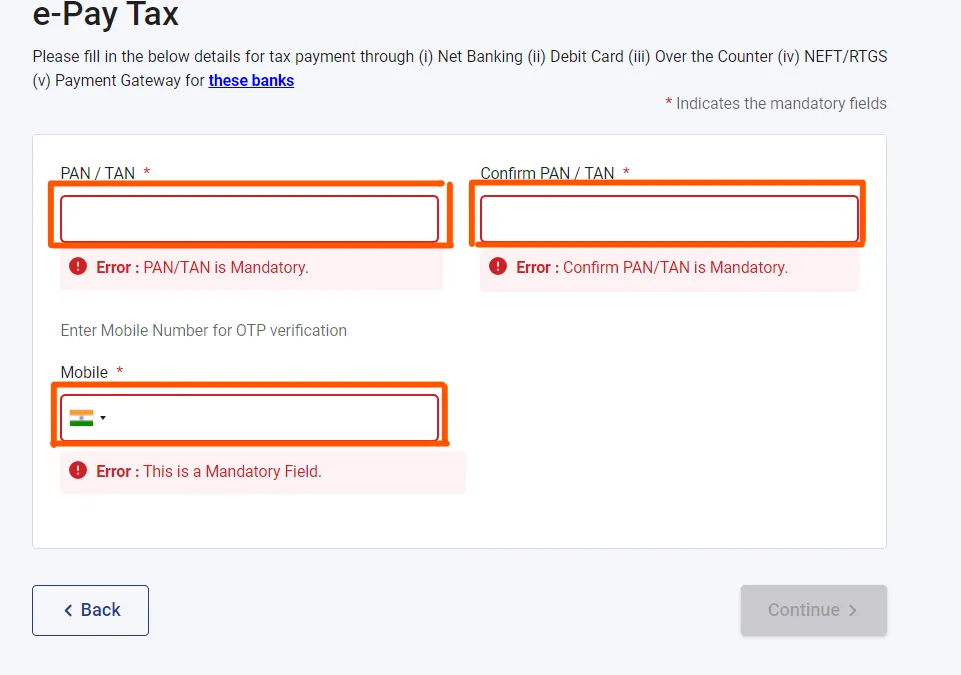

- Step 2: As you will be directed to a different site, you will find the option to enter your PAN/TAN number. Enter your PAN/TAN number along with your Aadhar registered mobile number.

- Step 3: You will receive an OTP for final verification

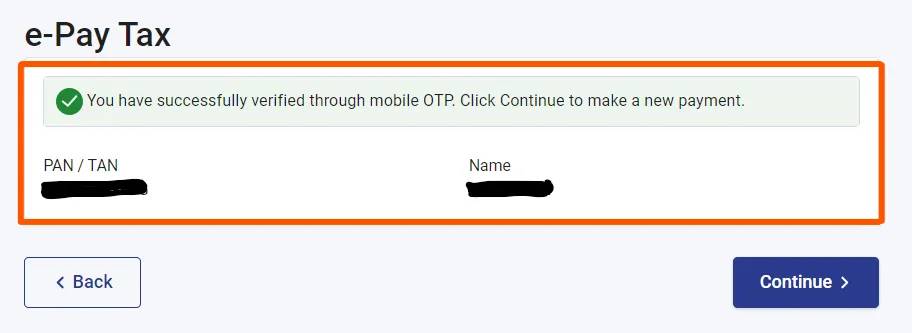

- Step 4: Confirm your details and click the Continue button

- Step 5: You will have to select the options as Equalisation Levy/ STT/ CTT

- Step 6: Next click the option Fee/Other Payments

- Step 7: Next you have to select the Assessment Year and the Type of Payment

- Step 8: Enter the tax amount you are liable to pay for online TDS payment

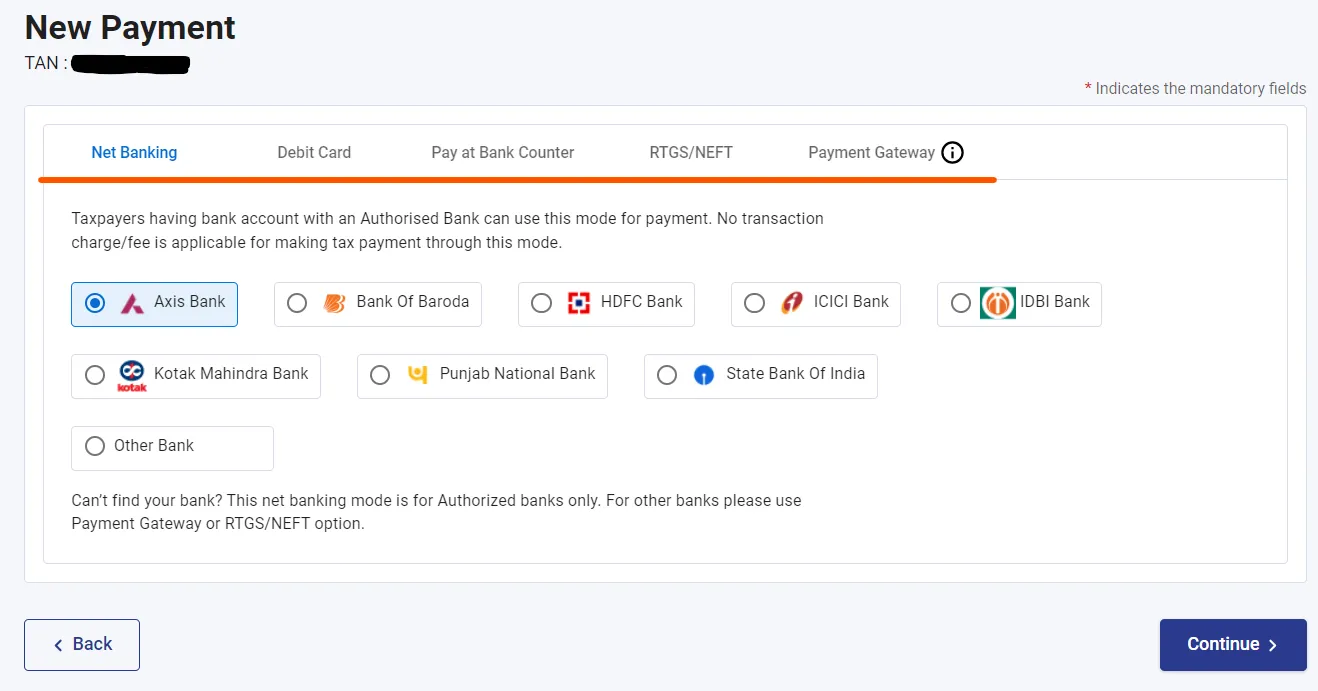

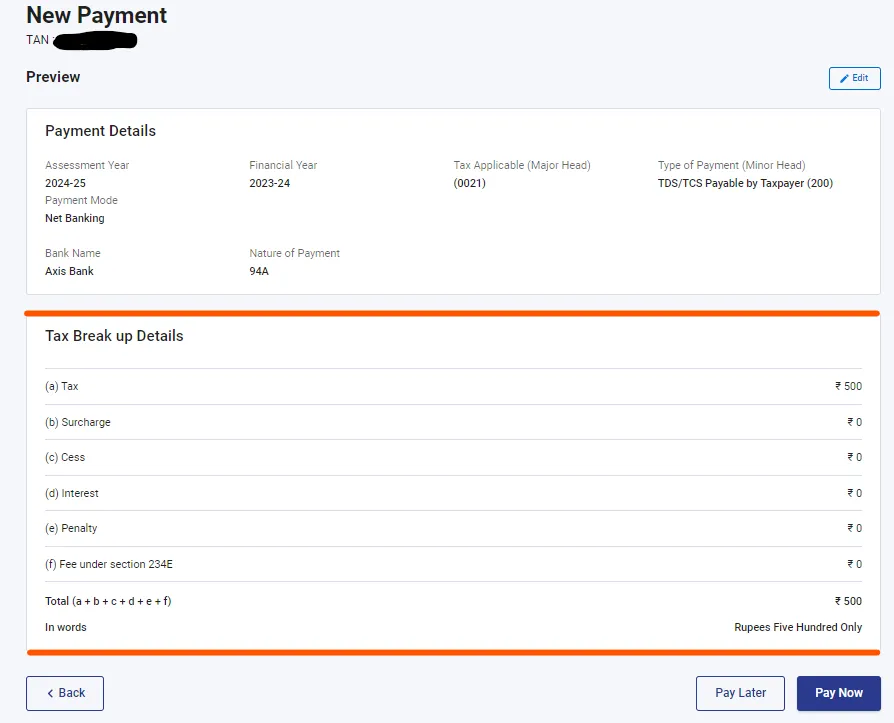

- Step 9: Choose your mode of payment and select the continue button. Currently, you can pay your TDS by UPI, Debit or Credit Card, or RTGS/NEF. Before clicking on payment, always check if your bank is listed in the accepted list of banks.

- Step 10: Verify your ID details on the challan and proceed to pay After successful payment, you will receive an e-challan. Preserve this TDS challan payment receipt with you for any future reference.

Read also about corporate tax, why it is important, and how to pay it.

What Is The Due Date For TDS Payment

Paying TDS within the due date is highly recommended, as late payment can levy some penalty charges. In case you miss the due dates, it can impose ₹200 as a fine per day. Avoid TDS payment late interest and all penalties by paying on time.

TDS Due Dates for 2025-26

| Month | TDS Payment Due Date | TDS Return Date |

|---|---|---|

| April 2025 | 7th May 2025 | 31st July 2025 |

| May 2025 | 7th June 2025 | |

| June 2025 | 7th July 2025 | |

| July 2025 | 7th August 2025 | 31st October 2025 |

| August 2025 | 7th September 2025 | |

| September 2025 | 7th October 2025 | |

| October 2025 | 7th November 2025 | 31st January 2026 |

| November 2025 | 7th December 2025 | |

| December 2025 | 7th January 2026 | |

| January 2026 | 7th February 2026 | 31st May 2026 |

| February 2026 | 7th March 2026 | |

| March 2026 | 7th April 2026 |

Benefits Of Completing TDS Payment Due Date

There are many benefits too for TDS online payment within the due date such as:

- Complying with the Income Tax Act

- Avoiding financial loss by not paying late fines

- Being a tax-abiding business owner/employee

- Have clear tax records for auditing purposes

- Option to claim a tax credit These are the reasons why you should not miss out on the due date for TDS payment. Paying on time will ensure that you have essentially complied with the tax laws and have a clean book of accounts.

Checking Online Payment Status

After you have cleared out your TDS payment, you will have to verify your payment status. Checking out the payment status is vital to make sure that you are not a defaulter on TDS. This is a step-by-step approach to make sure that your online TDS payment is on time.

- Step 1: Login to your account in the official portal of TRACES. TRACES is an online portal developed by the finance department to facilitate users track and check their TDS payment status.

- Step 2: Use your password, User ID, and PAN/TAN

- Step 3: Select the option “Statements/Payments Tab

- Step 4: Click the option of “Statement Status” You will be able to view the exact status of your TDS payment. You can also search this by a Token Number or by number of months.

Read also how to register for GST step-by-step.

Benefits Of Online Payment of TDS

There are multiple benefits of TDS online payment. These benefits include:

Tax-compliance

Paying out taxes in time is essential to be a tax-complying citizen of India. In time online payments also helps you to avoid cases of tax evasions, which can cause great financial disaster in the long-term.

Contribute In Wealth Distribution

By paying TDS, you contribute to the fair distribution of wealth in a macroeconomy. India has a wide economy with the need for wealth distribution. By paying out taxes, you help the government to redistribute wealth fairly.

Avoiding Late Fine

During auditing, you are not charged with late fines. Currently In India, if you miss out the due date for TDS payment, the interest is ₹200 per day.

TDS Payment Late Interest On Late Payment

There are mainly 2 types of cases of late payment which may occur.

- Late Submission of TDS

- Failure To Pay In Due Date Let’s discuss each of these.

Late Submission of TDS

Late submission is when you have collected the TDS from the employee, but have not submitted it to the Income Tax Department. Not submitting the tax will impose a monthly TDS payment late interest of 1%. This interest will be calculated from the date of actual payment to the government.

Failure To Pay In Due Date

In case you miss out the due date of your TDS online payment, a fixed penalty will be imposed on your salary deductions. In India, Section 234E of Income Tax Act has specified that a late fine of ₹200 will be directly deducted on daily basis for all those individuals who are failing to pay within the specified time. This means the longer you delay paying out, the higher the amount you end up paying. For example, if you delay paying TDS for 30 days, your total late fine will aggregate to ₹6,000. In case you have not paid TDS for more than a year, the income tax officer can file a heavy penalty of ₹10,000 - ₹1,00,000. The same penalty is also applicable if the TDS challan payment is deducted from your account but not submitted to the government within the due date.

Conclusion

The process to pay TDS payment online is simple if you go through all the steps. By filing for TDS payment, you comply with Income Tax laws and avoid any penalties as well as late fees. In Budget 2025, more tax relaxations have been provided to Indian residents. For senior citizens as well as for the regular wage earners, the finance department had increased the limit for tax payments. For prompt payment and not face any late fines, always check out the official portal of the Income Tax Department for updates.

Protect Your Founders With Directors and Officers Liability

As a business owner, you run a higher risk of financial loss in case you are charged with mismanagement or face inquiry by government agencies. These risks tend to slow down your business magnitude and can be severe roadblocks in gaining a full-fledged profit. Covrzy lowers all such risks with Directors and Officer’s Liability Insurance (D&O Insurance). Get covered for all legal expenses and protect your assets at affordable rates.

Frequently Asked Questions

Explore moreHow to get a TDS challan payment receipt?

Once you pay the TDS online, you will be able to generate an e-copy of the TDS challan. You can either download it or take a screenshot of the challan.

Which banks are approved under TDS?

To know the list of approved banks for paying TDS, please visit the official site of the Income Tax Department. You can also check in with your registered bank to inquire about TDS payment online eligibility.

How do I check the TDS amount?

To check the TDS amount, you can simply type in an online TDS calculator and check with the official online calculator by the Income Tax Department. The current TDS rate for each income slab is also released by the Central Government in the latest issue of the Central Budget.

Can I claim a refund on TDS?

Yes, you can claim a refund on TDS. To do this, you simply need to login to your account with your user ID. After logging in, submit your valid Aadhar and PAN number. Click on File Income Tax Returns and then select View Filed Returns. Here you can check your refund status and also apply for a refund.

What is the late payment fee on TDS of ₹50,000 salary?

The late payment for TDS for ₹50,000 salary will be 1% monthly fee imposed as penalty for not submitting the deposit. Monthly you will have to pay ₹5,000 for missing out the due date for TDS payment.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.