Critical Illness Insurance: Meaning, Coverage and Ways To Apply

Sourav Banik

Author

Critical illness insurance offers coverage for major illnesses that tend to damage life permanently, such as renal failure, heart attack, or cancer. In the 21st century, lifestyle-oriented diseases are on the rise. As medical costs in India are increasing sharply, a large population is susceptible to critical illness. Almost 14 lakh Indians are exposed to an increasing threat of cancer, while 10% of Indians are already affected with chronic kidney failures.

In this context, having a strong financial backup is essential. Critical disease insurance is majorly designed to offer a lump-sum payout in case the insured is threatened with a life-threatening disease (which has to be covered under the policy).

Let’s understand what is critical illness coverage, by breaking it down further with an example.

What is Critical Illness Insurance?

Critical illness policy is an insurance protection that offers financial coverage for critical illnesses such as a heart attack, cancer, tumor, or ulcer. These illnesses are fatal and can cause death if not treated in time. Whether you are a regular income earner, or a HR looking to improve your employee benefits, knowing the coverage and benefits of critical disease insurance is essential. As healthcare costs are steeping beyond limits in India, and the cost of hospitalization still stands high, only health insurance for critical illness is a feasible solution.

Also read: Is health insurance worth it?

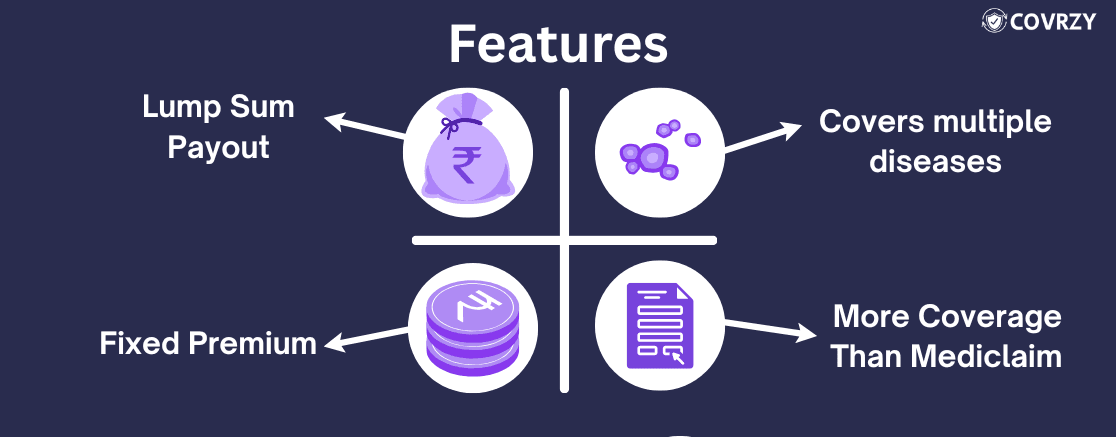

Features of Critical Illness Coverage

A critical illness coverage policy has a set of distinct features that differentiate that from the standard health insurance plan. Here are the key features:

Lump Sum Payout

A lump sum payment is provided to the insured at the time of need, even if the insured is not hospitalized. Diagnosis of a critical illness is sufficient for the insurance company to provide the full sum assured regardless of actual medical expenses.

Fixed Premium

Term insurance for critical illness provides a fixed sum assured irrespective of the hospitalization expenses. If your insurance policy covers the critical disease, you can claim the benefit even if your hospitalization expenses are quite high. This helps to build long-term financial stability.

Covers Multiple Critical Diseases

Whether it be a heart problem or a critical liver ailment, critical diseases insurance covers it. Cases such as stroke or long-term renal failure are also covered by this. Although not every insurer covers all critical illnesses, most of the critical diseases are covered.

More Coverage Than Mediclaim

In normal medical insurance, the insured can usually claim the reimbursement after being hospitalized. This is different in critical disease insurance. You can claim the reimbursement as soon as you are diagnosed with a critical disease, even before getting hospitalized.

Main Benefits of Critical Illness Insurance

- Critical illness coverage provides a range of benefits such as

- Financial protection during job loss due to critical illness

- Better flexibility to use your funds

- Tax benefits under Section 80C

- Helps to lower financial stress for your family if you are the sole earner

Let’s understand how critical sickness insurance provides these benefits, in detail.

Income Replacement

A major illness often refers to a long recovery period and a potential for job loss. Having a lump sum at hand ends the woe instantly, as critical sickness insurance acts as a substitute for lost income. The insured can easily stay afloat during financially constraining times.

Benefits of Taxation

You can claim tax benefits under Section 80C of the Income Tax Act for critical illness policy. Saving taxes will allow you better financial freedom too, as you get the complete benefit of the insurance claim.

No Anxiety and Stress

If you have a financial backup in case of a severe illness, you can easily relax without worrying about how to cover your medical expenses. This backup is provided by the critical illness coverage. You get a payout even if you are diagnosed with any mentioned critical illness.

Complements Existing Health Insurance

Critical sickness insurance is not a replacement for health insurance but acts as an additional protection for covering critical diseases. Many times you’ll find mediclaim policies not covering life-threatening diseases, and hence you cannot get reimbursement for that. Critical sickness is a perfect way to get reimbursement in such cases.

Fast Claim Settlement

Since the payout is fixed and does not depend on actual hospital bills, you can expect a faster claim settlement process. Also, claim settlement for critical illness is much less complicated compared to regular insurance.

Read also the benefits and use of AYUSH treatment in health insurance.

Should You Buy Critical Illness Insurance For Yourself?

Before giving you a straight answer, let’s justify why critical illness coverage is a necessity in today's age. This will also answer who should buy a critical illness policy.

You Are the Primary Breadwinner

When you are the breadwinner, responsibilities will always overshadow you. A critical illness policy is the only way to cover healthcare costs when you are hospitalized and your family is dependent on you entirely.

You have a Family Medical History

If you have a family history of critical diseases, such as liver ailments or heart attacks, then you are at a higher risk. Purchasing critical sickness insurance at the earliest will save you from a loss of lakhs afterward.

Your Employer-Provided Cover is Limited

If you are relying on your employer-sponsored group employee insurance, then it will not be sufficient. Usually, employer-sponsored group insurance doesn’t include coverage for critical diseases, for which you have to take a critical illness policy.

You Are Self-employed or Run a Small Business

If you are self-employed such as a freelancer or run a proprietorship business, the financial strain on you will be quite high. With no paid leave or employer-sponsored insurance, critical sickness insurance is the right solution to invest in.

Term insurance with critical illness is particularly valuable for individuals aged 30–50, as during this age usually, various lifestyle diseases begin to surface. Moreover, the financial responsibilities are at their peak at this age. You can also add a rider to significantly enhance your coverage without paying a high premium.

What Illness Does Critical Illness Insurance Cover?

Health insurance will cover only the cost of hospitalization expenses, such as payment for your hospital bill. This, however, differs when it comes to critical illness coverage.

But before that, the question is what does critical illness cover in term insurance?

Here is the critical illness insurance list that shows all the critical illnesses covered:

- Cardiac arrest

- Cancer (of a specific type as mentioned in the policy)

- Organ transplant

- Acute coronary symptoms as diagnosed

- Stroke resulting in permanent damage

- Major organ transplant

- Renal failure that needs regular dialysis

- Cardiovascular revascularization

- Multiple sclerosis where the symptoms continue to occur

- Paralysis of limbs that results in permanent damage

- Coma of specified severity

- Artery bypass surgery after diagnosis

Now, depending on your insurer, some critical illness policies also include certain diseases such as:

- Alzheimer’s disease

- Parkinson’s disease

- Primary pulmonary hypertension

- Loss of speech

- Severe burns

What Illness Is Not Covered by Critical Illness Policy?

Although the best critical illness insurance plans are extensive, they still exclude a few specific cases. Take note of the below:

- No coverage during the waiting period of 90 days

- Pre-existing conditions that were diagnosed before purchasing the purchase

- Death during survival is not reimbursed. You will usually get a survival period of 14-30 days, which acts as a waiting period before you can claim reimbursement

- Non-critical sickness or complications which is not life-threatening

- No coverage for HIV/AIDS

- No coverage for infertility surgeries or equivalent treatments

- Self-inflicted injuries or suicide attempts

- No coverage for any sickness that has developed because of war, any civil protest, or terrorist acts

- Cosmetic or non-medically necessary surgeries

While purchasing the insurance, it is crucial first to read the policy wording and consult with your insurer or financial advisor.

Still, feeling the complexity of the whole process? Let Covrzy help you understand the right insurance policy for you. Our insurance advisors are IRDAI licensed and have helped 500+ businesses before you choose the right insurance policy.

Read also what is free look period in health insurance and its benefits.

What is the Difference Between Health Insurance and Critical Illness?

Critical health insurance is often confused with health insurance or a medical policy. Although having both types of insurance is the best way to ensure maximum financial protection, you still need to understand their differences. Check them below:

| Basis of Difference | Critical Illness Insurance | Health Insurance |

|---|---|---|

| Coverage details | Covers critical diseases that can cause death (e.g. heart attack, kidney failure, cancer) | Covers only the hospitalization expenses for injuries and medical expenses |

| Claim settlement type | Lumpsum payment after diagnosing the critical illness | Provides actual medical expense |

| Cashless benefits | Does not has cashless benefit because of payment of lumpsum | Offers cashless hospitalization benefit |

| Validity | Terminates after reimbursement | Terminates only after the policy is cancelled or premium is not paid for long |

| Claim frequency | One-time, lump sum payment after diagnosis | Multiple times payment only if claims arise due to hospitalization |

| Waiting period | 30 days - 3 years | Till 90 days |

| Main objective | Offers financial assistance for covering critical illnesses that causes loss of job, family care | Offers financial assistance to pay medical bills and hospitalisation expenses only |

Many insurers these days offer the best critical illness insurance plans bundled with term plans for comprehensive financial coverage. If you still ask which is better, life insurance or critical illness, then there is no straight answer because both have their use. Critical illness offers financial benefits in case you encounter a life-threatening disease. On the other hand, life insurance provides financial benefits only during the policyholder’s death.

How To Claim Critical Illness Benefits?

Claiming critical illness insurance involves a few standard steps:

Step 1: Notify the Insurer

The first thing to do is contact your insurer once you get the diagnosis report

Step 2: Submit Documents

Next, you need to submit the policy documents to verify your identity and policy number. Along with this, submit the following documents:

- Diagnosis report

- Scans such as X-rays

- Certificate of doctor

- Prescription

- Diagnosis report

- Your identity proof (can be an Aadhaar Card/PAN Card)

Step 3: Complete Claim Form

You will be handed out a specific claim form, which you need to duly fill in. You can download this directly from your insurance provider’s website, or visit the insurance provider in person and ask for the claim settlement form. Fill out these details:

- Your full name

- Your policy number

- Date of insurance purchase

- Disease type you are suffering from

- Bank account details

Step 4: Claim Evaluation

After filling out the form, you will have to submit it either online or in person to the insurer. The insurer will verify the documents and assess if your medical condition is covered by the policy terms. Always remember before submitting to keep scanned copies of the same with yourself.

Step 5: Payout

On successful verification, the insurer will reimburse the claim amount directly to your bank. If you have a waiting period, you cannot claim within that specific period of time, so no reimbursement will be carried out during that time. Also, note that the hospital where you have checked in is empanelled. You can get more information on this by directly checking your critical illness insurance list, where names of the empanelled hospitals will be mentioned.

Read about maternity leave policy and how to apply for it.

How Does Critical Illness Claim Work?

Let’s understand how critical illness coverage works in a real-world scenario. Let’s begin this with an example.

Anshul, a 35-year-old sales manager, purchased term insurance with critical illness coverage in 2020. The coverage comes with a 3-year waiting period, with the sum insured worth ₹10 lakhs.

Four years later, Anshul experienced a stroke in his workplace. When he is rushed to the hospital, he is diagnosed with a serious heart condition. According to the diagnosis, the doctor needs to do a bypass surgery to treat the condition. The cost of surgery was informed to be around ₹8 lakhs.

Can Anshul use his critical illness policy to receive the cost of his bypass surgery? Let’s check out the boxes that are needed to claim the surgery benefits.

- The critical illness insurance list includes coverage for his surgery

- Anshul has the diagnosis reports along with policy documents

- Anshul is currently not in the waiting period

This shows that Anshul is eligible to receive the claim benefits, and he can easily apply for the reimbursement payout irrespective of his actual hospitalization. Critical illness policy pays out the benefits as soon as the diagnosis report is out, it doesn’t wait for actual hospitalization bills to be provided. This makes critical illness benefit a widely acclaimed claim for most people, as the policyholder can use the claim benefit for their treatment, or for covering family expenses.

Conclusion

Life is quite unpredictable, and health risks can surface at any point in time. Whether or not you are the only earning member of the family, being covered against health calamities is the wisest financial decision to take. A critical illness insurance policy ensures that one medical emergency doesn’t turn your life upside down, and provides coverage for a wide range of critical health failures. Whether you’re looking for insurance with critical illness benefits or assessing the best critical illness plan, ensure that the policy aligns with your health risks and financial goals. Always remember to check out the exclusions, and contact your insurer beforehand to have transparency.

Selecting the right critical illness insurance for your employees doesn’t require 100 meetings. Covrzy can assist you in obtaining group critical illness insurance at low premiums, specifically personalized to suit your business and team needs.

Frequently Asked Questions

Explore moreWhat are the five major critical illnesses?

The five major critical illnesses are heart attack, cancer, kidney damage, multiple sclerosis, and stroke.

Which insurance is best for covering critical illness?

To decide the best insurance, you should first inquire about the insurance provider based on the type of health risk you are suffering from and your budget. Depending on the type of critical illness and the diagnosis cost, you should select the best critical illness insurance plans.

What is the age limit for critical illness insurance?

The age limit for buying critical illness coverage is usually from 18 - 65 years. However, some insurers can provide a different age range, which you need to inquire by contacting your insurance provider.

What is the cost of treating critical illness in India?

Critical illness consists of major life-threatening diseases such as heart attack, kidney failure, stroke, cancer, and a few more. The cost of treating each of them can be quite high and varies across hospitals.

What is the waiting period for critical illness insurance?

The waiting period for critical illness policy usually ranges from 3 months to 3 years. While some insurance providers offer a lower waiting period, in a few cases it can stretch to more than a year also.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.