Rashtriya Swasthya Bima Yojana: Eligibility, Benefits And Steps To Apply

Sourav Banik

Author

The Rashtriya Swasthya Bima Yojana (RSBY) is a health insurance scheme that the Indian government provides to the unorganized sector workers. Around 2021-22, almost 43.00 crore workers from the unorganized sector have been found working without any protective health coverage. This report was published by the Ministry of Labour & Employment, highlighting the problematic situation of the unorganized sector.

Employment in this unorganized sector is mostly characterized by low or fluctuating income and poor job security. People living in this sector usually have little to no income, and many are also living below the poverty level. Because of this, most of the members of the unorganized sector cannot afford healthcare services that require hospitalization, or expensive medical diagnosis.

To mitigate this healthcare problem, the Government of India has launched the Rashtriya Swasthya Bima Yojana (RSBY) scheme. Now, over 3 crore Indians have subscribed to the RSBY scheme, which has gained massive popularity among the masses. This blog aims to explain the coverage details and benefits of the RSBY scheme in detail. It will also cover sections such as the registration process, and the eligibility to apply.

What is Rashtriya Swasthya Bima Yojana?

Rashtriya Swasthya Bima Yojana (RSBY) was launched on April 1, 2008, under the Ministry of Labour and Employment. The main objective behind the scheme is to offer insurance coverage to the below the poverty line families. Critical diagnosis and hospitalization expenses would be quite high for these people, which is why the RSBY scheme is so widely adopted in India.

This government policy offers hospitalization coverage up to ₹30,000 per family annually, on a family floater basis. This insurance scheme is a central scheme empaneled across multiple insurance companies and hospitals across India. The reason the scheme is famous is because of its cashless benefits and smart card access for the beneficiaries.

Read also the meaning and benefits of the free look period in insurance.

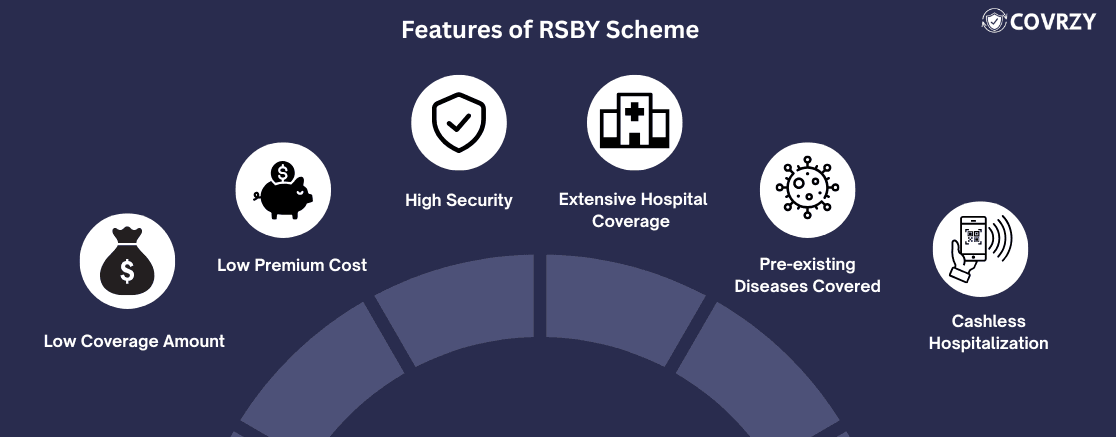

Features of Rashtriya Swasthya Bima Yojana

The features of this scheme are a combination of both unique as well as highly impactful. Here are all of them:

Coverage Amount

The scheme offers a total health coverage of ₹30,000 to every family on a family floater basis. Families belonging to the unorganized sector are highly benefited by the coverage, as it helps them to cover their pre- and post-hospitalization expenses.

Low Premium Cost

During the registration, the beneficiaries pay a nominal fee of ₹30, while the remaining premium is borne by the central and state governments. To be noted, the Central government bears 75% of the premium, while the remaining 25%is borne by the State government.

High Security

The smart card is another astonishing feature of the Rashtriya Swasthya Bima Yojana. This card is biometric-enabled, hence has a high degree of encryption. Moreover, the card uses fingerprint and other biometric details of the patient to verify identity, hence no one can bypass it.

Extensive Hospital Coverage

The beneficiary can choose between public and private hospitals easily with the card, which makes it a highly convenient option. Also, the smart card can be easily carried in a pocket, which ensures that migrant workers and their families get the complete benefit of the coverage.

A great feature of the scheme is that it allows any family to choose between public and private hospitals easily. This makes the scheme highly convenient also, as patients can easily switch to a hospital providing personalized healthcare.

Coverage for Pre-existing Diseases

RSBY provides the workers coverage for pre-existing diseases from the day one day of enrollment. The beneficiaries do not have to pay any extra costs for pre-existing diseases coverage, which is a great option for most people.

Cashless Hospitalisation

For both public and private hospitals that are empaneled with the scheme, the beneficiary can avail of cashless treatment. Migrant workers, especially, are highly aided because of this as they do not always carry cash while migrating to various states for workers, and a smart card helps them much.

Also know more about Pradhan Mantri Fasal Bima Yojana.

Benefits of Rashtriya Swasthya Bima Yojana

Almost 3 crore workers have been helped by Rashtriya Swasthya Bima Yojana. The scheme has been benefiting workers since 2014, where the wide range impacts of the scheme have not only stabilized the economic condition of the nation, but also has benefited numerous labourers to avail quality healthcare. Here are some key benefits:

Financial Risk Protection

Recovering from these medical emergencies is financially challenging for the unorganized workforce. This government health insurance scheme lowers this burden by covering major expenses such as inpatient care, major surgeries, and diagnosis expenses.

Health Access for the Marginalized

BPL families, domestic workers, street vendors, and any gig sector workers are quite vulnerable without any health insurance. These workers are regularly met with medical emergencies and, hence, are covered with RSBY insurance.

Offers Transportation Allowances

Laborers who may incur a lot of transportation expenses while visiting the city because of treatment factors are helped by this scheme to a great extent. High transportation cost is also another factor that earlier prevented the migrant workers from visiting quality healthcare in cities, which is now eased by the scheme.

Empowers Women and Children

The Rashtriya Swasthya Bima Yojana offers a family floater policy type for all the members, hence covering all the family members including spouses and children.

Cashless Hospitalization

One of the greatest benefits of the scheme is that it offers cashless hospitalization during medical emergencies. This means that anyone who is stuck in a health emergency is immediately helped with emergency admission to the hospital by just swiping the smart card.

Read also the benefits and steps to apply for Ayushman Bharat Card

Inclusions and Exclusions of Rashtriya Swasthya Bima Yojana

Inclusions:

- Hospitalization expenses including room charges, bed costs, doctor’s fees, medicines, diagnostic tests

- Post-hospitalization expenses which may cover additional scans and after-treatment care

- Coverage for all Pre-existing Diseases (PED)

- Coverage for daycare procedures, patient food cost, OT fees, X-ray scan reports, general and emergency ward bed charge

- Transportation allowance of up to INR 1,000 per year

- Maternity benefits for both normal and C-Section delivery

Exclusions:

There are also specific cases that the scheme does not cover. Here are these:

- Dental surgery costs

- Non-emergency cosmetic procedures

- Experimental or unproven treatments

- Coverage for hormone replacement surgery

- Coverage for substance abuse or alcoholism disease

- Coverage for congenital diseases

- AYUSH treatment costs

- Coverage in case of voluntary pregnancy termination A note of advice, before enrolling for the scheme, always note the exclusions and inclusions. The reason for this is that the scheme is also dependent on state-level implementation, because of which the coverage details may vary.

Eligibility to Apply for Rashtriya Swasthya Bima Yojana

The following criteria must be met for RSBY enrollment:

- The beneficiary must be a part of the unorganized sector and also must be lying below the poverty line

- The applicant should not be a part of any other health insurance scheme sponsored by the government

- The maximum number of family members must be five members

- The beneficiary must possess an Aadhaar Card/BPL Certificate/Ration Card/Voters ID Card

- The daily transportation allowance should not exceed ₹1,000 annually To confirm enrollment, the beneficiary must conduct a Rashtriya Swasthya Bima Yojana name check online by logging in to the official portal of RSBY.

How to Apply for Rashtriya Swasthya Bima Yojana

Here’s a step-by-step process:

Verify Eligibility

The insurance provider will publish an electronic list of all the eligible households for the scheme. This list will also be published by your nearest gram panchayat or zilla panchayat for public access.

Check the Schedule of Enrollment

The eligible households can check their names by visiting a cyber cafe. They can also check their names by directly visiting their nearest gram panchayat. If they are eligible, they will have to check the date of enrollment. This will be provided to the village council directly by the insurance provider.

Visit Enrollment Centers

Every village will have a specific schedule for enrollment in the scheme. These enrollment centers are usually held in government schools or temporary camps. Beneficiaries can visit the enrollment camp with their BPL certificates and identity proof.

Smart Card Issuance:

On collecting the biometrics details, the presiding officer will be issuing a smart card on-spot or within a few days.

How to Check Rashtriya Swasthya Bima Yojana Card Details?

If you want to do Rashtriya Swasthya Bima Yojana name check online, always check for the following details.

- Name, age, and gender of the enrolled beneficiary and their family members

- Unique identification number on the smart card

- Photograph and fingerprint data of the beneficiary with family members

- Date of birth

- Date of issuance Always match if these details are correct, as any error can result in the impaneled hospital rejecting your card benefit. Your responsibility will be to keep the Rashtriya Swasthya Bima Yojana card details safe to avoid any misuse of the card.

How to Claim Rashtriya Swasthya Bima Yojana Benefits?

Hospital Visit

First, visit any empaneled hospital nearest to you in case of any medical emergency

Smart Card Verification

Verify your identity with the smart card by producing the card at the hospital counter. The impaneled hospital will be verifying your biometric details along with your family members

Treatment

Once verified, the hospital proceeds with treatment up to the coverage limit. All the costs will be reimbursed along with the coverage details

Claim Filing

After varying the same card and appropriating the expenses, the hospital shares the claim online with the insurance company. The insurance-providing company then proceeds to process the claim benefits

Approval & Reimbursement

Claims are processed and settled digitally within a few days. In case of any post-hospitalization expenses, it may take a few additional days for the claims to get settled.

You must also do a Rashtriya Swasthya Bima Yojana card check online in case your insurance claim settlement is delayed to know if your card has expired. In case of expiry, the insurance company needs to be notified immediately for a renewal. The process is cashless, which makes it highly convenient and secure.

Conclusion

Access to quality healthcare is still a constraint in India for millions of people from the unorganized sector. The lack of financial resources and health security pushes most people into a debt trap, and hence poverty. The Rashtriya Swasthya Bima Yojana still stands out as one of India’s most impactful health insurance schemes to support the economically weaker sections of our society. The insurance scheme has been a boon for most people from the disorganized sector, protecting them from all health vulnerabilities during medical emergencies.

Frequently Asked Questions

Explore moreWhat are the benefits of Rashtriya Swasthya Bima Yojana?

There are multiple benefits of the Rashtriya Swasthya Bima Yojana that offer multiple benefits such as cashless hospitalization, coverage for 5 family members,. Few other benefits are offering maternity benefits, providing coverage for pre-existing diseases and so on.

How much does it cost to make a health insurance smart card?

It costs only ₹30 for one-time registration for making a smart card under the RSBY scheme. You can check your Rashtriya Swasthya Bima Yojana card details online even by just registering for this nominal fee during registration.

How many years of coverage does the health insurance scheme provide?

You will get coverage till 65 or 70 years with health insurance. However, the actual coverage term will depend on the state-level instructions also.

Where is a smart card made?

You can make the smart card by visiting the nearest enrollment center during the time of announcement. Usually, an announcement of the smart card in the enrollment center is made for smart card issuance.

What is the no. 1 health insurance in India?

There are a few health insurance policies that the government has rolled out, of which the Rashtriya Swasthya Bima Yojana (RSBY) is a famous policy. For all workers belonging to the disorganized sector at the BPL level, the RSBY scheme is a great opportunity as it covers most diseases at a minimal cost.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.