Pradhan Mantri Fasal Bima Yojana: Benefits And Features

Sourav Banik

Author

In the latest report published by the International Monetary Fund (IMF), India is ranked as the 4th largest economy in the entire world. India generates an annual national income of $4.9 trillion, where the statistics of IMF suggests that GDP has increased by 6.2% in 2025. This increase is indeed higher among other top ranking countries in terms of national income. While a large percentage of this GDP comes from crop production, most of the farmers are still not insured against crop damage. To cover these risks and financially assist our farmers, the Central government has launched the insurance scheme, known as Pradhan Mantri Fasal Bima Yojana (PMFBY). This blog will discuss at length the main objectives behind this scheme, its benefits, and how to apply it.

Also, read about the top 25 small-scale manufacturing business ideas to start.

What is Pradhan Mantri Fasal Bima Yojana?

In India, almost 40% of the farmers face crop damages because of extreme weather conditions, such as drought or excessive rainfall. While our farmers struggled to feed us, they themselves left with no insurance for their crops. While the crop sector contributes significantly towards the Indian GDP, it lies at the risk of crops getting damaged from natural disasters, with no financial backup.

The Indian government, to reduce the misery of farmers and protect them financially from crop loss, introduced the Pradhan Mantri Fasal Bima Yojana scheme. Pradhan Mantri Fasal Bima Yojana launch date was in 2016. All forms of natural disaster-borne damages are covered under this scheme, such as damage by drought, hailstorm, or excessive rainfall.

What Are The Premium Rates of PMFBY Scheme?

The rates of the scheme are described below:

| Crop Type | Insurance premium charges payable by the farmers |

|---|---|

| Kharif crops | 2.0% of the total insurance premium or the actuarial rate, whichever is lower |

| Rabi crops | 1.5% of the total insurance premium or the actuarial rate, whichever is lower |

| Kharif and rabi crops | 5% of the total insurance premium or the actuarial rate, whichever is lower |

Main Objectives of the PMFBY Scheme

The main objective of the PMFBY scheme is to develop a financial assistance program for the farmers so that even if they financially lose on crop damages, the damage can be still covered financially. The objectives of this scheme are:

- Offer financial assistance to all farmers against crop damage

- Improve farming methods and support farmers to take up modern farming techniques

- Create an even distribution of income among farmers

- Bring financial stability to the lives of farmers by insuring their crops against natural calamities

- Improve the credit-worthiness of farmers

- Build growth statistics and also encourage competition

Read also how to start import import export business in India.

Benefits of Pradhan Mantri Fasal Bima Yojana

The Pradhan Mantri Fasal Bima Yojana list has a long list of benefits. Here are a few of them:

Zero Cost Premium For North-Eastern States

Farmers are not charged any premium in various states such as Himachal Pradesh, Jammu & Kashmir and few more. Any farmers who own lands in these states or lease, do not have to pay a premium and get a complete waiver.

Extensive Coverage Against Natural Disasters

PMFBY scheme is India’s first crop insurance scheme that provides comprehensive coverage against most disasters. Disasters such as cyclones, droughts, hailstorms, and floods are all covered by this scheme. Farmers remain assured of getting covered because of the long list of inclusions of this scheme.

Low Insurance Premium

PMFBY scheme offers a highly affordable premium for farmers, which makes it a widely adopted insurance scheme among farmers. As per the latest government reports, farmers need to pay only for 2% for kharif crops, and 1.5% for rabi crops. The remaining 98% insurance premium is provided by the government.

Faster Claim Settlement

Another great benefit of the Pradhan Mantri Fasal Bima Yojana list is farmers can claim their insurance benefits within just 2 months. This results in a great advantage for farmers, as they can easily claim their insurance benefits without long delays. Farmers also don’t get easily into debt traps, as within 2 months they get complete financial coverage for their damaged crops.

Since 2016, almost 29.19 crore farmers have registered under this scheme across India, making the scheme the most widely adopted scheme ever in Indian history. Countless farmers have benefited through this scheme, even though Indian monsoons and harsh winters have always threatened crops and farmers. Faster claim settlement and holistic coverage make the scheme ideal for farmers.

Inclusions of PMFBY Scheme

Here is a detailed list of all the inclusions under this scheme:

Poor Yield Losses Covered

Kharif crops and Ravi crops, both are always vulnerable to damages caused by weather calamities. The Pradhan Mantri Fasal Bima Yojana (PMFBY) scheme offers comprehensive coverage for disasters in notified areas such as:

- Extensive periods of drought

- Periods of storms

- Hailstorms and snowstorms

- Flood

- Inundation

- Landslide

- Pest infestation

- Crop diseases due to adverse weather conditions

Coverage For Post-harvest Losses

The scheme provides coverage for all post-harvest losses too. After the harvesting season is over, farmers often store away their crops. During this post-harvest period, crops can suffer damage in quality such as being exposed to the sun for longer periods or being destroyed by natural disasters. The PMFBY offers support for 14 days in addition to after the harvest season is over.

Sowing Prevention Cases

Farmers may not be able to sow because of poor weather, or frequent weather disturbances. This can cause the farmers to be entirely dependent on the weather conditions, which used to cause immense losses for the farmers. The insurance scheme of the Indian government has empowered most farmers because farmers can claim 25% of the claim benefits.

Coverage For Local Damages

Local damages such as floods, hailstorms, and landslides can excessively damage crops. The government-launched scheme has saved thousands of farmers from the loss by providing coverage for such local damages. Any crops that are completely damaged or even lose their quality of yield, are insured with the PMFBY scheme.

Read more on the small business ideas to start in 2025.

Exclusions of the PMFBY Scheme

Although the scheme covers most of the damages, it still excludes a few special cases. Here are they:

No Coverage For Loss Outside Crop Cycle

If any losses arise outside the specified crop cycle, such losses are not covered. Only losses that occur during the growing season are covered. If you read the inclusions in the Pradhan Mantri Fasal Bima Yojana list, you will know that coverage is provided only for the crops during the crop cycle, and not outside of it.

Loss Due to No Maintenance

All losses that occur because the farmers have neglected crop maintenance, or have neglected the quality of harvest are not covered by this scheme. In case a farmer does not abide by the best agricultural practices, it may result in crop damage. Such damage is not covered by the scheme whatsoever be the extent of damage be.

Coverage Limit

The scheme follows certain criteria to assess the extent of the damage, which excludes coverage if the loss exceeds the predefined limit. This limit may be specified within the scheme details and may be revised by the board based on the damage caused.

No Coverage For Non-Notified Areas

There are a few areas that are not covered under this scheme, which are better known as non-notified areas. Note that the scheme is applied on an area basis, and the crop in the area has a similar risk exposure. These areas can be geo-fenced or mapped to assess the actual risk homogeneity for the notified crop.

Eligibility To Apply For PMFBY Scheme

To apply for the PMFBY scheme, the first thing a farmer needs to do is to check if they are eligible to receive the claim benefits. Here is a concise, but detailed explanation of the scheme:

- Only farmers who have valid documents that prove the ownership of their land will be allowed to apply for the scheme's benefits

- Both loanees as well as non-loanee farmers can apply for the scheme's benefits

- The farmer needs to own mandatory documents such as an Aadhar Card, proof of land ownership, bank account proof, and tenant agreement documents

- The farmer should apply within the given period, which can be either one week or 2 weeks immediately after the beginning of the sowing season

- Farmers need to have an insurable interest in the protected harvest

- The farmer must not have applied and already claimed compensation for the same crop loss from any other source

- The farmer must be either cultivating the land, or a sharecropper of the land

- All categories of farmers, which include tenant farmers and sharecroppers are allowed to apply

- If these eligibility criteria are met, a farmer can visit their nearest bank branch, or check with an insurance company and submit the required documents.

Documents Needed To Apply

To apply for Pradhan Mantri Fasal Bima Yojana, you would require these documents:

- Identity proof (your Aadhaar Card/PAN Card/Voter ID Card/MNREGA Card/Bank Passbook)

- Residential address proof (this can include either your identity proof such as an Aadhaar Card, or also an electricity supply bill or bank statement)

- Land ownership documents

- Tenant agreement papers

- A written or recorded document that declares the sowing of crop

- A passport-signed photo

How To Apply For Pradhan Mantri Fasal Bima Yojana?

Here are some simple steps that you can follow to apply for the PMFBY scheme online:

Online Application Process

-

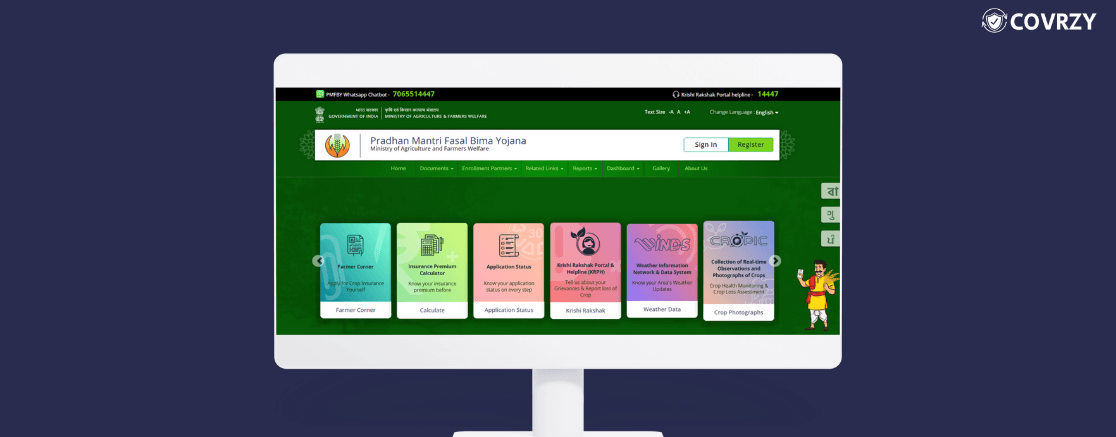

Step 1- First visit the official portal of Pradhan Mantri Fasal Bima Yojana

-

Step 2- You will see a section known as “Farmer Corner” on the left side of the screen. Click on that

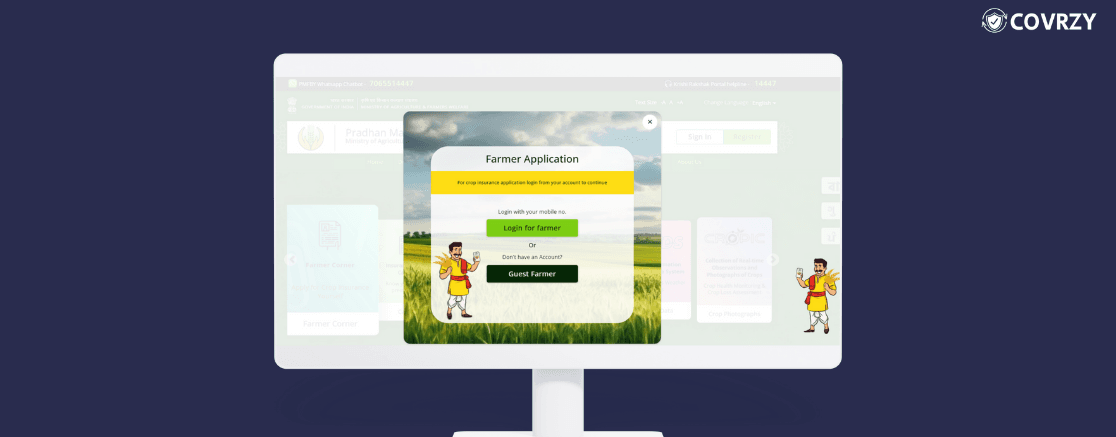

- Step 3- A new panel known as “Farmer Application" will appear. In this section, two distinct sections such as Login for Farmer and Guest Farmer will be displayed. Click the “Guest Farmer” option

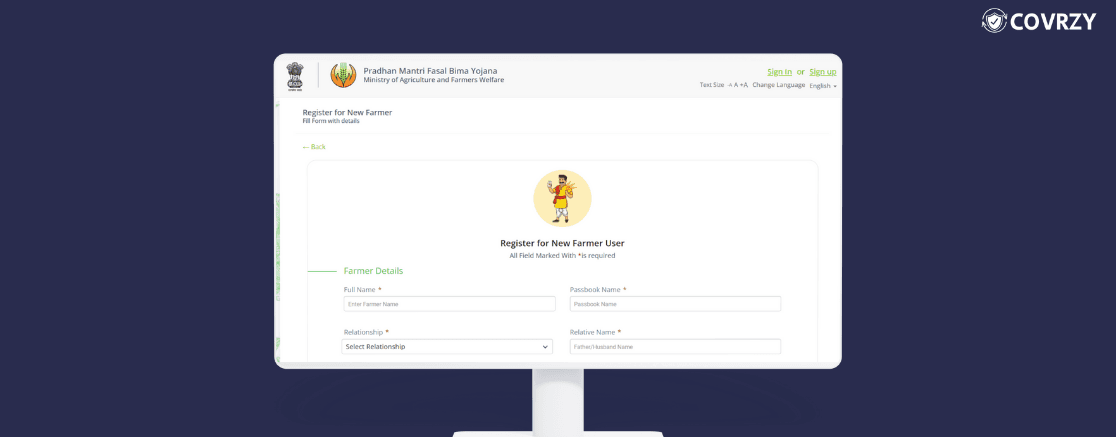

- Step 4- Here, you will be taken to a different page named as "Register For New Farmer” option. You will be prompted to input details such as farmer name, passbook name, bank branch, residential details, and so on.

- Step 5- After successfully filling up the online form, fill in the CAPTCHA and click on the “Create User” option.

- Step 6- After this, you will be directed to the Login page. Choose the option for “Login For Farmer” there.

- Step 7- Add details such as contact number, check the CAPTCHA again, and click on the “Request for OTP” option

- Step 8- You will receive an OTP in your registered mobile number, which you need to fill in again and click the “Submit” option

- Step 9- On successful submission, you will be directed to a page known as “Farmer Application Form”. Note that this page is important, as here you will have to input details regarding your land, along with the necessary documents. Click “Submit” after the submission of documents and your details.

- Step 10- You will be able to see a new popup window that lists the payment options. You can click the “Pay Later” option in case you want to purchase the insurance at a later stage, or you can also immediately pay. With that, your application process comes to an end. You should also stay updated always about the latest Pradhan Mantri Fasal Bima Yojana news. For this, visit the official portal of PMFBY and click the “What’s New” section. This will get you all the updates about changes in the scheme and also inform you about some of the latest dates.

Offline Application Process

The offline process can take time as compared to the online one, so here it is.

- Step 1- Visit your nearest bank branch or a participating insurance company. Upon visiting, you can ask for the farmer application form, which can be a 2-page form where you have to fill in your essential personal details.

- Step 2- You may have to attach a passport-sized photo of yours, provide your signature, and submit all the documents that are required to apply.

- Step 3- After submitting the documents, pay the premium amount to the authorized personality

- Step 4- The authorized personnel will supply you with an application reference number. This reference number will help you to track the application status of your submission.

Also, read how to apply for Ayushman Bharat Card in simple steps.

How to Check Your Application With the PMFBY Scheme?

You can check your PMFBY status by Aadhaar Card online with these steps.

- Step 1- Visit the site of your insurance company, or the participating bank that has registered your details

- Step 2- You will see a page that asks for your Application Number and your Aadhaar Number. Input these details and click on the “Submit” or “Search” option

- Step 3- You will be able to check your application status directly after successful submission

Conclusion

The Pradhan Mantri Fasal Bima Yojana is a holistic insurance solution launched by the Indian government to protect farmers from accidental crop damage. Every year, thousands of farmers register for the scheme because of large coverage, and extended benefits. The scheme has been widely appreciated too, because of its protection of the farmers and helping them to avoid getting into debt traps. Moreover, this insurance has been able to inject credit into the agricultural sector of India for the last 9 years.

Frequently Asked Questions

Explore moreHow do I check my name in the PMFBY list?

You can check your name and also track your application status by visiting the official site of the Pradhan MantriFasal Bima Yojana scheme and selecting the Application Status option. Input your policy ID number, and you will be able to view your application status and name.

When will I get the money from the PMFBY scheme?

Usually, within 10-15 days, you will be eligible to receive the insurance claim benefit. However, always contact your bank or your insurance company while inquiring about the premium benefit claim.

How much money will I get from this insurance scheme?

To calculate the insurance money under the PMFBY insurance scheme, you would first need to check the exact area of your land insured, the year of crop harvest, and your distinct name. Depending on these details, you can calculate the insurance money for your crop.

How to register for the PMFBY scheme with mobile?

You can directly call the helpline number 14447, issued by the Ministry of Agriculture and Farmers. If you own a smartphone, you can also apply for the scheme by installing the official app, Crop Insurance app from Playstore or Appstore.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.