Why Are NBFCs Offering Less Loans Under ₹50,000? Learn How Loan Protection Insurance Can Help

Sourav Banik

Author

- NBFCs are limiting loans under ₹50,000 because of defaults on small-ticket lending

- Unsecured microfinance loans carry higher risk and higher operational costs

- Tighter RBI norms and stricter credit bureau checks has also limited small size lending limited

- Loan protection insurance compensates NBFCs when borrowers default due to death, disability, or job loss

- It helps to stabilize high default rates and lowers pressure on borrowers

- The future of NBFC lending is AI, decentralized lending, and embedded finance as it may revive the microcredit ecosystem

- Loan protection insurance acts as a financial safety net and can help NBFCs serve low-income borrowers

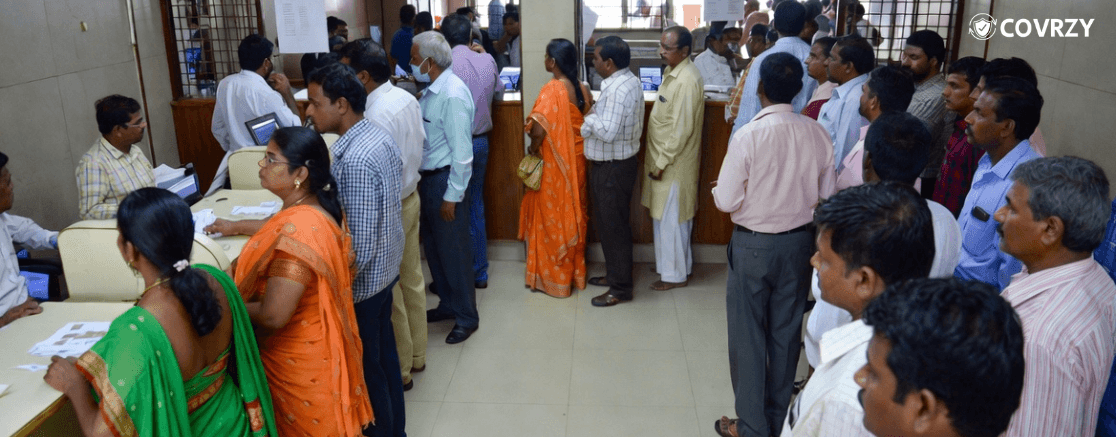

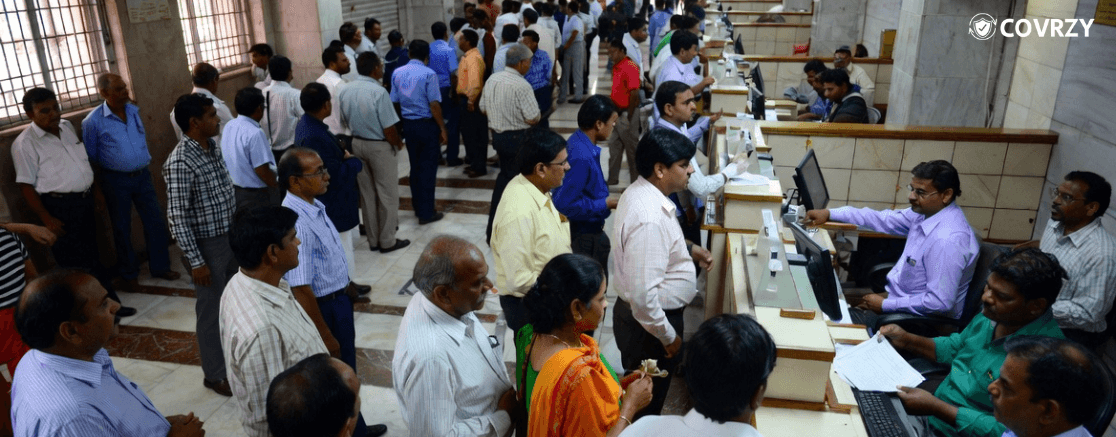

Non-Banking Financial Companies (NBFCs) have long been the life support for the Indian economy. Research indicates that nearly 61.20% of loans are funded by NBFCs, with the retail sector being funded at a rate of 28.7%. But in 2025, the scenario has changed. NBFC-MFIs are lowering their limits on offering loans under ₹50,000, mainly due to the number of defaults. Can loan protection insurance help NBFCs in this situation? Let’s find out.

Why Are NBFCs Not Offering Loans Below ₹50,000?

There are multiple reasons as to why NBFCs are lowering their lending for small-ticket loans. These factors are described below:

Default Rates Has Risen

Almost 33% Indians take loans to fulfill their EMIs, and the rest towards running their small business or acquiring assets. But the concerning pattern is that the rate of defaults is rising for loans under ₹50,0000. Non-repayment of loans under ₹50,000 has been slowly rising, which makes NBFCs refuse loans outright.

High Risks For Unsecured Loans

The major reason for the RBI to lower the limit of lending under ₹50,000 is the risks these small-ticket loans carry. Usually, these microfinance loans are unsecured, and hence they run a high risk of default. TransUnion CIBIL reported that the consumer durable loans (loans taken usually for purchasing household goods) have also reduced.

Operational Costs Exceeding Profit Margins

Another reason is that the operational cost is exceeding the profit margin for the banks, which is a major limitation for disbursing loans under ₹50,000. The operational cost, including KYC verification and credit assessment, is the same for a ₹50,000 loan and a ₹5 lakh loan, which is why NBFCs are slowly retiring small-cap loans.

Regulatory and Credit Bureau Challenges

The Reserve Bank of India (RBI) has introduced more stringent criteria for lending, given the rate of defaults has risen. For lending to directors, the loan limit has been set at ₹1 crore after rigorous verification.

Also read the difference between claim rejected and claim repudiated.

How Loan Protection Insurance Can Solve the Problem

A loan protection insurance essentially acts as a lifeline for the microfinance industry and NBFCs. Let’s get into more details.

What Is Loan Protection Insurance?

A loan protection insurance is the reimbursement amount that the insurer pays to the bank on when a borrower fails to pay off their loans. The borrower can fault or repay the debt due to unforeseen circumstances such as death, disability, or involuntary job loss. It is a loan coverage insurance that compensates the bank on behalf of the borrower to minimize the loss.

Here are 4 ways in which a loan protection insurance can help NBFCs and microfinance institutions to cover in case of loan defaults.

How Loan Recovery Insurance Can Help?

Here are some ways a loan recovery insurance can aid banks to reduce their risk of loan defaults:

Protect Against High Default Rate

The high default rate among borrowers is a major concerning trend. If a bank lends 4 loans, each less than ₹50,000 at an annual interest of 8.5%, and 3 out of 4 default, the bank suffers a loss of ₹1,62,750, including the principal amount. While this is only for explanation purposes, a bank lends to lakhs of customers in a given month, which makes the default highly fatal.

Protection For House Loans

In cases of house loans under ₹5 lakh, the situation is worse. In March 2025, mid-stage loan defaults rose to 4.94%. On a year-over-year basis, the loan default for home loans has increased by 0.33%. Home loan protection insurance helps in this situation, as it offers coverage in case of defaults and the borrower’s inability to repay.

Helps Defaulters

In case of death or any permanent disability, sometimes borrowers default on loan repayment. A loan protection insurance provides complete coverage to the lending institution, as well as to the defaulting parties. Defaulters do not remain in acute financial stress because of loan repayment, as the insurance has already compensated for the default loan.

Improves Credit Offer Facility

When borrowers know they're protected, they can act financially more responsibly. The psychological burden of debt reduces, leading to better engagement with lenders. Having insurance also provides banks with a strong financial backup even if loan defaults continue to progress.

Real-World Case Study

The small commercial loans by Indian NBFCs are facing an acute crisis in 2025. News reports even stated that the small-ticket credits are the worst affected, as most of the small loan borrowers are not repaying in the required time. The rate of pending credit has risen to 1.9%, which was 1.3% in 2024. Most businesses that borrow under ₹10 lakh have faced the largest repayment failure. These repayment failures include both failure to repay and delay in repayment.

This is why NBFCs and banks need loan protection insurance, as it offers complete coverage when their small-ticket loans are increasingly high. Banks and NBFCs are constantly monitored by the RBI on credit health, which gets disturbed when there are too many defaults lined up. A loan coverage reinsurance prevents this and allows NBFCs to disburse loans with efficiency.

Also know how to manage corporate health insurance premium after a layoff.

Future of Small-Ticket Lending

When banks withdraw from providing microcredits to these businesses, the economy starts to slow down. However, the future may be different. Let’s take a quick look at how the future for small-sized loans can be:

AI Can Lower Credit Risk

Artificial Intelligence is storming into change the world of small-ticket loans in the next few years. From early risk detection to auto-flagging of high-risk accounts, AI is set to change the entire way NBFCs work. Research studies show that AI integration has been powering more financial literacy and loan reimbursement in rural areas.

Decentralized Lending Increasing Transparency

DeFi technology uses an open source model, where the risks are generally low because of high transparency. Moreover, the borrowers need to use cryptocurrency collateral during borrowing, where the crypto collateral is more valuable than the borrowing itself, which neutralizes the risk.

Embedded Finance

This can be another future scenario where NBFCs might integrate their tech stack into non-tech platforms for ease of buying. NBFCs often provide unsecured loans, which is why integrating them in non-tech platforms can be more valuable for user access. For example, integrating a direct loan facility into WhatsApp can make it easier for the user to access credit.

Conclusion

NBFCs pulling back from loans under ₹50,000 is a strict business decision because of rising defaults among Tier-III inhabitants, razor-thin margins, and increasing operational headaches. A loan protection insurance cuts down the bank's risks and offers complete protection so that lending institutions can lend with confidence. In the coming days, with real-time data on income and smart credit assessment, small-ticket loans are expected to be accessible to even the most marginalized borrowers.

India’s NPA problem and non-repayment of loans have always affected the banking industry. Don’t bear the liability of unpaid loans and lose your stakeholders. A credit life insurance can save you from this, and let you offer credit without worrying about the repayment deadline. Call Covrzy at 9354963947 to book a free quote for your firm today.

Frequently Asked Questions

Explore moreWhat is the maximum loan for NBFCs?

As per RBI guidelines, NBFCs are allowed to sanction only ₹1 crore per borrower.

Does RBI restrict NBFCs from granting loans?

No, RBI doesn’t restrict NBFCs in granting new loans, but there are certain guidelines that NBFCs need to follow for lending new loans. A board-approved policy and general following of RBI rules are mandatory.

Which are the banned NBFCs in India?

Navi Finserv, Asirvad Microfinance, DMI Finance, and Arohan Financial Services are banned by RBI guidelines from approving any new loans.

After how many days does my CIBIL score reset?

Usually, the CIBIL score resets after every 1-3 months, but depending on a positive credit history, it can also reset earlier.

Are NBFC loans safe?

NBFC loans are unsecured loans, which means that these loans are not supported by any collateral and usually bear more risk to banking institutions. This is why most banks opt for a credit life insurance policy.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.