Types of Allowances in Salary: Taxable, Non-Taxable & Examples

Sourav Banik

Author

What is an Allowance in Salary?

The basic question that any fresher employee or an intern may ask is - what is allowance in salary. An employee may undergo various expenses, such as paying for living expenses as well as expenses for commuting to the workplace. All of these expenses are sometimes reimbursed by the employer. This type of reimbursement is known as an allowance and is based on the actual expenses that the employee has paid. Allowances are predetermined, and are paid by the employer over the existing basic salary of the employee. This can be reimbursement for house rent, mobile bill, or travel allowance.

A major component of the employee’s salary is constituted of allowance, and in this blog we will discuss the various types of allowances. Allowances can be taxable, non-taxable, or partially taxable based on their nature and the provisions under the Income Tax Act, of 1961.

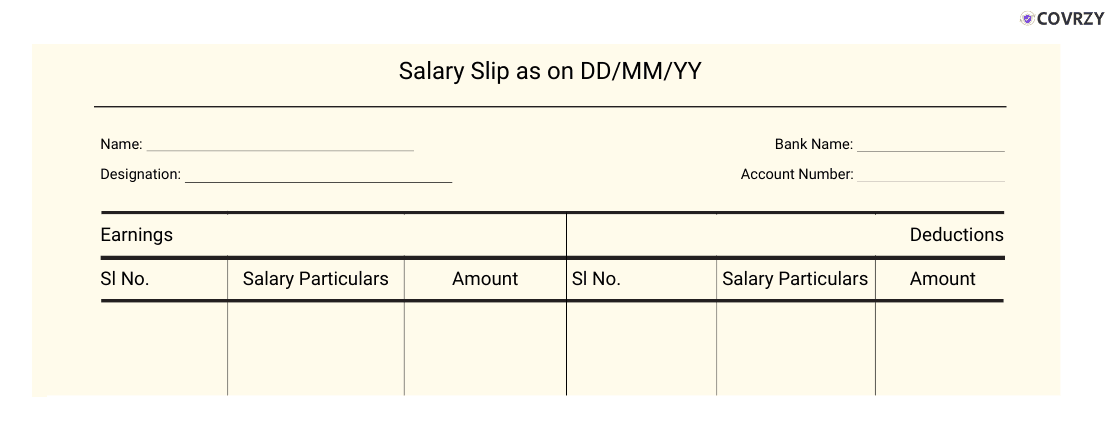

Different Types of Allowances in Salary Slip

In an employee’s salary slip, different types of allowances can be reimbursed. The types of allowances are classified based on the taxability provisions made under the Income Tax Act, of 1961. There are three main kinds of allowances, here are they:

Taxable Allowances

Taxable allowances are those which are subjected to a suitable slab of taxation according to the Income Tax Act, of 1961. A taxable allowance is included in the taxable income of the employee, hence making the employee liable for paying the tax. There are mainly three different types of taxable allowances:

-

Dearness Allowance (DA): This allowance is different from any other types of allowance in salary slip given its purpose. This allowance refers to the compensation paid to employees for adjusting to the increase in the cost of living due to inflationary expenses. DA varies from region to region because of the variation in the living cost, hence companies do not provide a specific DA to every employee. In some companies, the DA is classified according to urban location, semi-urban and rural location.

-

City Compensatory Allowance (CCA): The CCA is given to employees inhabiting metropolitan areas, or in cities that have a higher cost of living. Usually, for employees working in Tier-I cities, CCA is paid to compensate for the high cost of living. An allowance example for CCA is payment to an employee staying in an urban Bengaluru location. It is to be noted that CCA is not a fixed compensation, and varies according to the city location and industry standards.

-

Special Allowance: Special Allowance is another allowance given to employees apart from the basic salary, and is usually based on the employee's performance. Examples of special allowances are bonuses, incentives for additional hours worked and so on.

-

Overtime allowance: This allowance is quite popular among various types of allowances. An overtime allowance is paid to any employee who works overtime or works after the expiry of actual working hours. The additional hours worked by the employee are counted as overtime, and the overtime allowance is calculated based on that. This increases the variable compensation for an employee.

You may also read more about fixed and variable compensation.

Non-Taxable Allowances

In the glossary of allowance, there are both taxable and non taxable allowances. While taxable allowance is that which is subjected to major tax slabs, non taxable allowance refers to allowances that are exempted from taxation. The Income Tax Act does not impose any such tax on a non-taxable allowance, below are some examples to highlight this type of allowance.

-

Medical allowance: Among different types of allowances, a medical allowance allows employees to consult doctors, avail medications and have treatments for their family members.

-

Allowance for judges of the Supreme Court and High Court: According to the Salaries and Conditions of Service Act, 1958 and 1954, the judges of the Supreme Court and High Court are paid a specific allowance. The allowance for Supreme Court judges is paid out of the Consolidated Fund of India, while the allowance for High Court judges is paid directly from the Consolidated Fund of States.

-

Leave Travel Allowance (LTA): This allowance is granted to the employees to compensate for the expenditure on journey during the leave. LTA is exempted from taxation subject to some conditions and maximum amount. Usually a leave travel allowance is limited to travelling in economy class, and travelling within India.

-

Uniform Allowance: Many companies and job roles demand wearing a specific uniform. This allowance compensates an employee for the purchase and maintenance of such uniforms needed for work.

Partly Taxable Allowances

After taxable and non-taxable allowances, comes the concept of partly taxable allowances. Partially taxable allowances are those in which the allowance is partly subjected to taxation, while the remaining part of the allowance is tax-free. Here are some examples:

-

House Rent Allowance (HRA): Employees who have relocated to a different city other than their native residence for workplace relocation, are paid this type of allowance. A house rent allowance compensates employees for all expenditure incurred on the house rent. HRA is exempted from taxation as per Section 10 (13A) of the Income Tax Act, 1961.

-

Children's Education Allowance: This allowance is granted to employees for paying off their children's education. For every child, this allowance is fixed at INR 100. This stipulated amount per child is non-taxable and is usually paid by the Indian government to the employee.

-

Hostel Expenditure Allowance: This allowance is granted to employees to pay for their children's hostel fees. A stipulated allowance of INR 300 is paid per child, which is partially exempted from tax and non-taxable, while the rest allowance is taxable.

-

Entertainment Allowance: This allowance is treated as a partially taxable allowance, and only employees serving the government are eligible for this type of allowance. Usually the non-taxable amount is 1/5th of the total allowance value.

Taxable vs Non-Taxable Allowances: Key Differences

| Basis of Difference | Taxable Allowance | Non-Taxable Allowance |

|---|---|---|

| Meaning | Taxable allowances are subjected to direct tax deduction | Non-taxable allowances are exempted from form of tax deductions |

| Beneficiary | Private sector employees | Government employees |

| Tax Treatment | The allowance is included in an employee's taxable income | This allowance is not recorded as a taxable income |

| Impact on CTC | Impacts the CTC as the entire allowance is tax liable | Does not impact the CTC |

| Impact on Gross Income | Gross income including the allowance is reduced because of tax submission | Gross income is not affected due to non-taxability |

| Examples | Dearness Allowance (DA), City Compensatory Allowance (CCA), Special Allowance | Medical Allowance, Leave Travel Allowance, and Uniform Allowance |

Employees need to know the amount of taxation charged, which will allow them to manage finances correctly by understanding the allowances charged. The CTC and take-home salary are both impacted by the taxation, so knowing which allowances are taxable and which are exempted is a vital knowledge for taking financial decisions. Moreover, knowing the main types of allowances powers employees to have better control over their salaries.

Employers also take into consideration the tax implication of allowances in designing salary packages. They will design the salary structure to have maximum benefits to employees while they keep the tax burden to a minimum. Employers can formulate a tax-optimized salary package by incorporating taxable, non-taxable, and partially taxable allowances.

How Employers Structure Allowances in Salary Packages

- Employers have to take into consideration various factors before designing the allowances, such as the work location of the employee, taxability of the allowance, requirements for travel, industry norms and also job roles of employees.

- They also pay attention to the tax treatment of these allowances and attempt to optimize the salary structure to keep the tax burden minimum.

- Employers often resort to seeking advice from tax professionals to design an optimal salary package comprising a combination of taxable, non-taxable, and partially taxable allowances.

Factors Impacting Allowance In Salary Package

- Industry norms have a key influence on what and how much allowance employers give. Usually industries vary in determining the actual allowance, such as allowance in the HRM industry is different from the IT industry.

- Businesses usually study and examine the allowance frameworks common in their sector to maintain competitiveness in employee attraction and retention. For instance, India's IT sector has a practice of providing a set of allowances like HRA, LTA, and flexible benefits plans to ensure a holistic remuneration package for employees.

- Employee job roles and responsibilities also determine the allowances they get. Employers can provide various allowances depending on an employee's level of job, skills, and experience. For example, senior executives might get more HRA and LTA than entry-level employees. Sales-based jobs have travel allowances, while Tele-calling employees may get an allowance for cellphone reimbursement.

- Company policies and the allocated budget are important factors for designing the allowance. Often companies design the allowance keeping in scope the major budgetary limitations and policy as directed by the Board members. This is done to balance competitive allowances with management of labor expenses.

Often the human resource department of the company tends to consult with tax specialists who specialize in compensation and benefit schemes. The specialists assist the employers to learn the tax implications of different allowances and provide advice on how to reduce economic pressure on both the company and the employee tax liability.

Get to know more about direct and indirect tax and how these taxes impact the business.

Recently, even salary structuring tools are gaining wider use among employers in optimizing salary structures through allowances. These tools majorly assist employers in understanding the tax effect of various combinations of allowances and in identifying the most tax-effective salary structure.

Employers need to periodically review and readjust their allowance structures so that they are relevant and competitive. Tax law changes, industry trends, and staff expectations could necessitate adjustments to the current allowance structure. Periodic communication with employees regarding their allowances and the resultant tax implications is also needed to keep staff transparent and trustful.

Conclusion

Both the employee and the employer need to possess the basic knowledge of the types of allowances in salary disbursement. For employees, the knowledge of taxability can help in effectively planning their finances and complying with tax regulations. Employers, on the other hand, benefit from this knowledge to design such salary packages in a manner that maximizes employee benefits and reduces the tax burden on the corporation. Both employees and employers can make effective decisions on salary structures and financial planning by understanding the different types of allowances and their tax implications.

Frequently Asked Questions

Explore moreIs it better to claim 1 or 0 allowances?

Claiming 0 allowances means more tax is withheld from your paycheck, potentially leading to a larger refund at tax time. Claiming 1 allowance reduces the amount withheld, increasing your take-home pay but possibly resulting in a smaller refund. Choose based on your financial needs and tax planning strategy.

What qualifies as non-taxable income?

Non-taxable income includes inheritances, gifts, cash rebates, alimony payments (for post-2018 divorces), child support, most healthcare benefits, welfare payments, and reimbursements from qualifying adoptions. These are not subject to income tax.

What are examples of withholding allowances?

Withholding allowances impact the tax withheld in your paycheck. Some examples are taking the Child Tax Credit, itemizing deductions rather than taking the standard deduction, and claiming additional income from interest or dividends.

Is allowance non-taxable income?

Most allowances are taxable, but some allowances are tax-exempt. For example, Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS) are generally tax-exempt, while Conus COLA is tax-exempt.

What are taxable allowances in a salary?

Taxable allowances are Dearness Allowance, Overtime Allowance, City Compensatory Allowance, and Special Allowance. These are taxable in full and should be added to your gross income for tax purposes.

What are non-taxable allowances in a salary?

Non-taxable allowances are House Rent Allowance (HRA), Leave Travel Allowance (LTA), Uniform Allowance, and Conveyance Allowance to certain limits. These allowances are exempt from tax subject to certain conditions.

How can employees optimize tax benefits from allowances?

Employees can optimize tax benefits by knowing which allowances are taxable, partially taxable, or non-taxable. Using non-taxable allowances such as HRA and LTA, and maintaining tax compliance, can maximize tax savings.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.