What is Corporate Identification Number (CIN)? Meaning, Format & Importance

Sourav Banik

Author

For any business, being legitimate and meeting the overall compliance requirement are two completely varied aspects. CIN full form stands for Corporate Identification Number (CIN). This number is a major part of a company’s legal identity and is mostly required for audit. If you own a business in India, having a good understanding of CIN is of good importance. Moreover, according to the legal requirements for a business, a company is required to have a CIN to show its stock market listing status as well as reveal other necessary information.

This blog discusses CIN meaning, its major importance, format, and abbreviations used in a CIN.

Understanding CIN

A CIN number has a larger role to play in maintaining the legal and regulatory aspects, as required by the Companies Act for taxation and compliance purposes. Every company has to pass under the authority of the Registrar of Companies, which makes CIN incorporation a compulsory affair for a company. In any meeting, whether it be an Annual General Meeting or an Extraordinary General Meeting, a company has to publish its reports to the present stakeholders. A CIN allows a company for such events and ensures that there is complete transparency for regulators, major stakeholders, as well as several third-party stakeholders. A CIN is applicable for these companies in India:

- Private Limited Companies

- State Government owned companies

- Central Government-owned companies

- One Person Companies

- Not-For-Profit Companies

- Non-Banking Financial Company (NBFC) Although the main benefits of CIN will be explained later, it still can be remarked beforehand that a CIN is required in cases of tax audits, financial assessments and cases of legal inquiries.

Importance of CIN

The CIN is needed for a diverse set of causes, here are some of the listed causes.

Legal and Registration Validity

CIN is a unique number assigned to a company during its registration under the Registrar of Companies, so an importance of CIN is that it shows the registration details of a company. Moreover, a CIN is also needed to be declared legal in India, as directed by the Ministry of Corporate Affairs (MCA) in the Companies Act, 2013.

Tracking

CIN is one of the most effective ways for the Indian government to keep a close track of the main activities and operations of the company. In case a company tends to evade tax, the Indian government can easily track down the registration and other incorporation details of the company. Moreover, companies are required to supply the main obligatory information to their RoC, where CIN plays a vital role. Tracking offers timely tax payment and promotes transparency of all activities of a company.

Business Operations

A CIN number is compulsorily required for any cases where the company needs to apply for or renew its license. In case the company declares a division of shares or a change of directors, a corporate identification number is needed. Moreover activities such as issuing company shares or applying for any governmental grant, a CIN is needed.

Transparency

It proves transparency and provides the easiest door for stakeholders, creditors, and other partnering firms to check a company's legal status and financial propriety. CIN is a key tool for any due diligence process and provides an effective means by which companies can convey their credibility. CIN provides a higher transparency for all stakeholders, investors and creditors. Any stakeholder can obtain the CIN number and inquire about its legal incorporation, and tax filing details.

Compliance and Accountability

The Ministry of Corporate Affairs (MCA) has set CIN as an essential incorporation requirement for all companies. Having CIN thus makes sure that a company is complying with the laws of the Companies Act, and ensures a proper governance structure. Also, from the aspect of regulatory compliance, a CIN is a strong requirement that every company needs to respect.

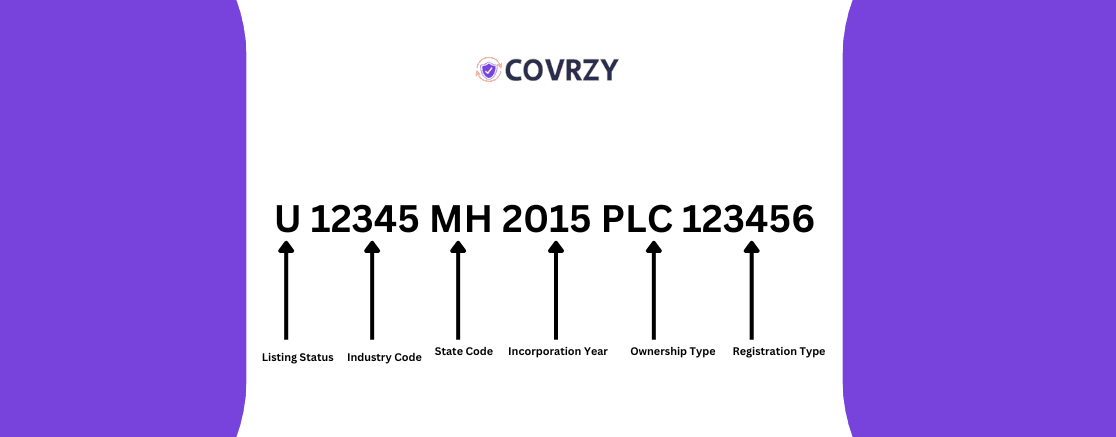

An established format is used for the Corporate Identification Number. The format of a CIN is: XX-XXXXXX-XXXXXX-XXXX This is explained as follows:

- The first two characters (XX): These represent the industry classification code. For example, 'U' stands for unlisted and 'L' stands for listed companies.

- The next five characters (XXXXXX): These identify the registration state for the company. Every state in India has its own code. For example, MH is for Maharashtra & DL represents Delhi.

- The next four characters (XXXX): These are for the year of incorporation and denote the year the company was registered. For example, 2015 would give the impression that the company was registered in that year.

- Last six characters (XXXXXX): These serve as an identification number to distinguish that company specifically.

An example of CIN will be U12345MH2015PLC123456, where:

- U stands for unlisted.

- 12345 is the registration number of the company.

- MH represents Maharashtra (state code).

- 2015 is incorporated in the year 2015.

- PLC stands for public limited company.

- 123456 will be the company's special identification in the latter part. One can easily search for the CIN through the online portal provided by the Ministry of Corporate Affairs (MCA). Here is a quick guide for searching the CIN details -

- Visit the MCA official website to find a business CIN number.

- You will get several options to search by the registration number or CIN details.

- Type in the full name of the company or the registration number. At this point, the CIN number of the company should have come up with its status, date of incorporation, and other details. Instead, many third-party websites have databases that include CIN details. These websites can be very useful if you want to quickly find a company’s legal position, particularly if you are working with a lot of businesses or in the process of forming B2B partnerships.

Compliance and Legal Aspects of CIN

The Corporate Identification Number (CIN) is more than just a company's regulatory identification: it is an extremely important part of compliance with the requirements of various corporate laws for the smooth running of businesses. Some of the aspects of compliance relating to CIN are:

- Annual Filings: All companies in India are required to file their annual returns and financial statements with the Registrar of Companies (RoC). The CIN should be unique and easily linked with all such documents related to any given company. Such measures ensure that firms can keep in compliance with the filing obligations imposed on them under the Companies Act, 2013.

- Change in company conditions: Changes such as a company's name changes, change of address, or other modifications must reflect the updated CIN records maintained by the RoC. Furthermore, companies are required to inform the RoC of changes in the structure of their organization, such as mergers, acquisitions, or internal restructuring processes.

- Tax Returns: The unique property identification number per interlocution is needed for filing an income tax return as well as GST filing. This helps to create efficiencies in the entire taxing process and guarantees compliance with the tax regulations. This number is often a prerequisite for the review of an enterprise's tax audits in determining the outcome of the financial transactions of the enterprise.

- Company Status Verification: The CIN allows anyone to verify whether or not a business is active, undergoing liquidation, or has been dissolved. In addition, this helps ensure due diligence prior to entering a business deal or partnership. Thus, for investors, clients, and suppliers, verifying a business's CIN is a means through which they establish the legality of such businesses.

- Contractual Obligations: When parties enter into contracts, particularly B2B contracts, the corresponding CIN is often quoted for record verification. This essentially helps in establishing the validity of the parties to a disputed contract and helps smoothen some associated legal processes in the event of a conflict.

Conclusion

A useful identification number for registered businesses would help maintain a record and monitor compliance of their businesses with special reference to the regulatory framework administered by the Indian government. Based on this, a Thorough Examination of the Corporate Identification Number (CIN) will not only make it easier for you to develop your startup further but also save you in more ways than you can think of if it means that you are within the laws of the land and compliant to the least. CIN acts as an authority for companies that seek to establish market credibility and venture into new markets. Moreover, companies that are highly focused on B2B partnerships and try to develop a high market credibility, are also required to have CIN. This number enhances transparency and establishes a higher diligence which is required for the creation of partnerships and developing investor relationships.

Frequently Asked Questions

Explore moreIs it possible to change the CIN?

Once assigned to a company, no change can be made to the CIN. Henceforth, it has to be the same for the entire lifetime of a company, which creates uniformity in records and legal documents.

How to find out if a company is registered?

Company registration status can easily be verified using the CIN through the Ministry of Corporate Affairs website or through other third-party tools that provide company information.

Are all companies in India required to have a CIN?

Yes, all companies that are private, public, and limited and registered in India must apply for a corporate identification number. It is a must-have identification for regulatory and compliance purposes.

Is CIN the same as GSTIN?

No, the CIN is not a GSTIN. The corporate identification number is issued by the Ministry of Corporate Affairs, while the Goods and Service Tax Identification Number refers to tax-related aspects under the GST regime.

Where do I find a company CIN?

You can find the CIN of any company by searching the official MCA website by either its company name or the registration number. The CIN will be displayed along with other details.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.