Gross Profit vs Net Profit: Know the Difference

Sourav Banik

Author

This is one of the first things a startup owner should do - check on all the major transactions, oversee the balance sheet and be aware of the income statements. Keeping a close tab on these ensures that the finance of the startup is well-maintained, and has no loophole to spot on. This is true for any form of business, whether it be an established corporation or a legacy business. Knowing certain accounting metrics, such as the difference between gross profit and net profit, is a highly useful parameter in the long run. Although the two terms may be used interchangeably, they are different. You will get to learn more about these differences, and also explore how these concepts apply to modern-day business accounting.

What is Gross Profit?

First, let’s start with explaining the topic - what is gross profit? Gross profit refers to the amount remaining after selling a good at the marked price after deducting the cost of production. More simply, gross profit is the difference between manufacturing cost and sales price. Now, there are a few costs that are included in the gross profit formula. These are shipping charges from manufacturers to warehouses, all costs incurred directly while manufacturing, and delivery costs. All of these costs appear before the final sales, so they are included in the original cost price of a good.

How to Calculate Gross Profit?

Formula: Revenue from sales - Cost of manufacturing

Let’s understand with an example of a B2C shoe company.

A shoe company earns a revenue of ₹6,00,000 monthly and directly sells to the consumer through their showrooms.

If the cost of manufacturing is ₹1,50,000 per month, then the Gross Profit will be:

Revenue from sales - Cost of manufacturing = ₹(6,00,000 - 1,50,000) = ₹4,50,000

What is Net Profit?

The concept of net profit differs considerably from gross profit. While gross profit is the difference between total sales and total cost of sales, net profit is the difference between total sales and total cost of operating the business. The direct answer to the question - what is net profit, is that net profit is the profit a business generates after deducting total expenses from total sales revenue. Thus, the basic difference between gross profit and net profit is net profit measures the profit a business earns after deducting tax and overhead expenses, while gross profit only measures the profit earned after deducting basic production expenses.

How to Calculate Net Profit?

Formula: Total revenue from sales - Total cost of manufacturing

Calculating net profit is a bit complex as it involves computation of all of the expenses that the business is involved with. Net profit, however, should also not be confused with economic profit, which takes into account opportunity costs. But to understand what is net profit, we have to get into an example.

Let’s get back to our previous example of the B2C shoe company.

The total expenses of the company including rent, advertising expenses and daily wages of workers amount to ₹2,50,000 per month.

The cost of manufacturing shoes monthly is ₹1,50,000 per month, while the revenue from sales is ₹6,00,000 monthly.

Total expenses = Manufacturing cost + (rent + advertising expenses + daily wages of workers) = 1,50,000 + 2,50,000 = ₹4,00,000

Total revenue earned = ₹6,00,000

Net profit = Total revenue earned - Total expenses = 6,00,000 - 4,00,000 = ₹2,00,000

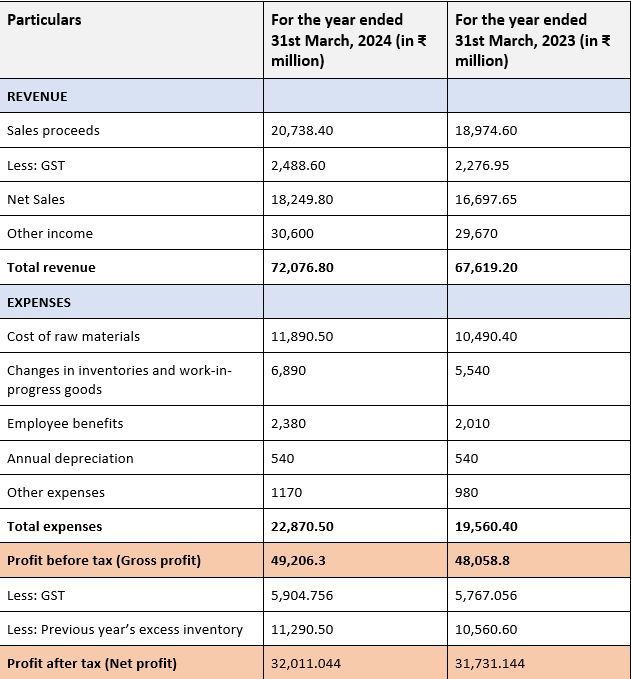

How do Gross Profit and Net Profit appear on the Income Statement?

An income statement is a consolidated statement for companies to understand if it is making a profit or not. An income statement is an accounting proof for knowing the returns for the investors. Here is a fictitious income statement to explain gross profit and net profit.

Key Differences Between Gross Profit and Net Profit

The key difference between gross profit and net profit lies in the elements they include and the objective of gross and net profit. A table is provided below to list all the differences:

| Parameters for Difference | Gross Profit | Net Profit |

|---|---|---|

| Meaning | Gross profit is the profit left after deducting the manufacturing cost from total revenue | Net profit is the profit left after deducting the total cost from total revenue |

| Formula | Total revenue - Cost of manufacturing | Total revenue - Total cost |

| Aim | To optimise the major costs in manufacturing items and understand per item productivity | To understand efficiency of business and estimate the profitability |

| Usability | It provides the firm with the nature of productivity | It provides the firm with the real profit scenario and true financial position |

| Treatment in Finance | Appears in Credit column of Trading Account | Appears in Credit column of Profit and Loss Account |

| Inclusions | Includes manufacturing cost, cost of shipping, overhead expenses, taxes and excise duty | Includes all costs incurred to run the business, interest paid on any loan credit, taxes |

Why Understanding Gross and Net Profit is Essential for Businesses

Any business irrespective of size and investment, starting from small scale to startups, should understand the meaning of gross profit vs net profit. These points clarify the major reasons why understanding these concepts is essential for any business.

- Understand the nature of earnings - By knowing the exact gross and net profit, a firm can easily arrive at the conclusion about the organisational ability in earning. For example, by calculating the gross profit margin, the firm can conclude better the profitability from direct sales. Another example can be the net profit margin, which aids the firm in ascertaining the ability of the organisation to optimise the operational costs.

- Ascertain ROE for investors- All investors require the company to publish their annual reports consolidating the Return on Equity (ROE), which measures the returns investors have received from investing in the company. ROE requires an understanding of net profit for accurate ascertaining.

- Estimate margin of operating profit - Operating profit calculation includes depreciation, allowances, and sales proceeds. Understanding this is a crucial decision for any firm. It is only after understanding this, that a firm can arrive at the decision of how well it is performing in terms of optimising fixed costs and paying off its debtors.

Conclusion

Understanding the difference between gross profit and net profit is the key step towards having a concrete approach to knowing the overall performance of a firm. A firm can perform quite well only when it is aware of all the financial ratios, which needs to calculate the gross and net profit. Estimation of gross and net profits provides a series of benefits. These benefits can create an overall scenario of the capacity of the firm to meet its financial obligations or estimate the ability to perform in the long run.

Frequently Asked Questions

Explore moreWhat is the main difference between gross and net?

There is a major difference between gross profit and net profit. While gross profit does not consider the total expenses needed to run the business, net profit considers the total amount of expenses borne by the firm.

Which is bigger net or gross?

The higher profit margin is gross, as gross profit considers only the manufacturing costs. Net profit is always lower than gross as the net ratio considers the deduction of the entire expenses from revenue.

What is a good net profit ratio?

As per the standard set benchmark, a 10% profit ratio is considered a good ratio, while 20% is considered a financially healthy ratio.

What is a normal profit margin?

A normal profit margin completely depends on the industry and the type of business the firm is engaged in. For example, the profit margin of a restaurant business may never match the profit of a hardware manufacturer.

Do you have more questions?

Contact us for any queries related to business insurance, coverages, plans and policies. Our insurance experts will assist you.